Commercial organization - entity, pursuing profit making as the main goal of its activities, as opposed to non-profit organization which is not intended to make a profit and is not distributes profits among participants

The main features of a commercial organization

Purpose of activity - Receiving a profit;

Well defined in law organizational and legal form;

Profit distribution between participants legal entity.

Also, commercial organizations have all the features inherent in a legal entity:

Have separate property on the rights of ownership, economic management or operational management, other property rights; the property may be leased;

Responsible for their obligations their property;

Acquire and exercise property and non-property rights on their own behalf; have responsibilities;

Can be a plaintiff and defendant in court.

Commercial organizations are divided into three large categories: organizations that unite individual citizens (individuals); organizations that combine capital and state unitary enterprises (Fig. 3.4). The former include business partnerships and production cooperatives. The Civil Code clearly distinguishes partnerships - associations of persons requiring the direct participation of founders in their activities, companies - capital associations that do not require such participation, but involve the creation of special management bodies. Business partnerships can exist in two forms: a general partnership and a limited partnership.

IN full partnership(PT) all its participants (general partners) are engaged in entrepreneurial activities on behalf of the partnership and bear complete liability for his obligations. Each participant may act on behalf of the partnership, unless otherwise established by the memorandum of association. General partnership profit distributed among the participants, as a rule, in proportion to their shares in the share capital. For the obligations of a general partnership, its participants bear joint and several liability with their property.

partnership in faith, or a limited partnership (TV or CT), such a partnership is recognized in which, along with full partners there are and participants-contributors (limited), which do not take part in entrepreneurial activity partnerships and have limited liability within the limits of their contributions. In essence, TV (CT) is a complicated type of PT.

In a general partnership and limited partnership, shares of property cannot be freely assigned, all full members bear unconditional and joint and several liability for the liability of the organization (they answer with all their property).

Business partnerships(ХТ), as well as business companies (HO), are commercial organizations with authorized (share) capital divided into shares (contributions) of founders (participants). Differences between CT and HO appear, in relation to their more specific forms, in the ways of their formation and functioning, in the characteristics of their subjects in terms of the degree of material responsibility of these subjects, etc. In the very general view all these differences can be interpreted in the context of the ratio of corporate partnerships.

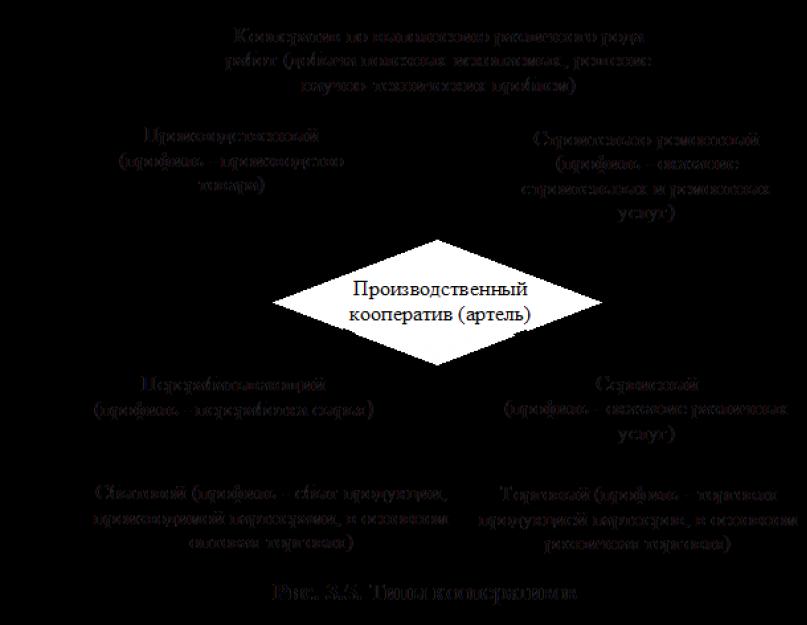

Production cooperative(PK) is voluntary association of citizens on the basis of membership for a joint industrial or other economic activity based on their personal labor or other participation and the association of its members (participants) of property share contributions. The features of the CP are the priority production activities and personal labor participation of its members, the division of the property of the PC into shares of its members (Fig. 3.5).

Cooperatives and organizations with the participation of workers in management and profits, which served as a spread in the mixed economy, have certain advantages over entrepreneurial-type companies in labor productivity, social climate and labor relations, income distribution. The introduction of essentially socialist principles of organization into economic activity (the participation of workers in management, in profits and in the ownership of shares) is seen as a means of overcoming the difficulties that entrepreneurial-type organizations constantly face: bureaucratization management structures in large corporations; weak interest of workers in the success of the company (because their remuneration is still limited by salary); losses from strikes and labor conflicts; high turnover of the workforce, associated in the current conditions with especially high costs due to the growing costs of training workers for specific activities in this particular organization, etc.

But purely self-managed companies lose out to entrepreneurial ones in a number of ways: in addition to reacting weakly and possibly back to market signals in the short term, they are prone to “underinvestment,” i.e., eating away their profits; in the long run, they are conservative in risky projects and technical innovations.

Joint-Stock Company(AO) is a society, the authorized capital of which consists of the nominal value of shares company acquired by shareholders, and, accordingly, is divided into this number of shares, and its participants (shareholders) bear liability up to the value of their shares(Fig. 3.6). Joint-stock companies are divided into open and closed (JSC and CJSC). Members of JSC may dispose of their shares without the consent of others shareholders, and the company itself has the right to conduct an open subscription for issued shares and their free sale. In a CJSC, shares are distributed by closed subscription only among its founders or other predetermined circle of persons, and the number of founders in Russian law is limited to 50 persons.

But there is a third, "hybrid" category - a society with limited liability and an additional liability company - which simultaneously refers to organizations that unite individuals and organizations that unite capital.

Limited Liability Company(LLC) is a company whose authorized capital divided into shares participants who bear liability only within the limits of Art. the value of their contributions. Unlike partnerships, an LLC creates an executive body that exercises current management of its activities.

Additional Liability Company(ODO) is essentially a type of LLC. Its features: joint and several subsidiary liability of participants for obligations ALC with its property in the same multiple for all to the value of their contributions, determined in the constituent documents; division in the event of bankruptcy of one of the participants in the ALC of his liability for the obligations of the company between other participants in proportion to their contributions.

to state and municipal unitary enterprises(UE) include enterprises that are not endowed with the right of ownership of the property assigned to them by the owner. This property is in state (federal or subjects of the federation) or municipal property and is indivisible. There are two types of unitary enterprises (Table 3.1):

1) based on law economic management(have broader economic independence, in many respects act as ordinary commodity producers, and the owner of property, as a rule, is not liable for the obligations of such an enterprise);

2) based on law operational management(state-owned enterprises) - in many ways resemble enterprises in a planned economy, the state bears subsidiary liability for their obligations in case of insufficiency of their property.

The charter of a unitary enterprise (UE) is approved by the authorized state (municipal) body and contains:

The name of the enterprise with an indication of the owner (for state-owned - with an indication that it is state-owned) and location;

The procedure for managing activities, the subject and goals of activities;

The size of the authorized fund, the procedure and sources of its formation.

The authorized capital of the UE is fully paid by the owner before state registration. The amount of the authorized capital is not less than 1000 minimum monthly wages as of the date of submission of documents for registration.

If the value of net assets at the end of the financial year is less than the size of the statutory fund, then the authorized body is obliged to reduce the statutory fund, about which the enterprise notifies creditors.

The property rights of a unitary enterprise are presented in Table. 3.2. A unitary enterprise may create subsidiaries of the UE by transferring a part of the property to them for economic management.

4. Non-profit organizations as subjects of business law.

Legislation on non-profit organizations. The main normative acts regulating the legal status of non-profit organizations are the Civil Code of the Russian Federation and the federal law January 12, 1996 No. 7-FZ "On non-profit organizations" (as amended on December 30, 2006 No. 276-FZ), providing for general provisions that apply to all forms of non-profit organizations. Along with them, there is a list of special federal laws that contain additional regulation of certain forms of non-profit organizations.

These include: Law of the Russian Federation of June 19, 1992 No. 3085-1 "On consumer cooperation(consumer societies, their unions in the Russian Federation)" (as amended on March 21, 2002 No. 31-FZ), Federal Law of May 19, 1995 No. 82-FZ "On public associations"(as amended on February 2, 2006 No. 19-FZ). Special laws have been adopted for chambers of commerce and industry, non-state pension funds, the Central Bank of the Russian Federation (Bank Russia), associations of employers. Relatively recently, on November 3, 2006, the Federal Law “On Autonomous Institutions” was adopted.

The list of federal laws defining the status of non-profit organizations could be continued. But this is not necessary. Another thing is important: the status of non-profit organizations as subjects of civil law is determined by acts of the federal level. According to the authors of the Concept for the Development of Corporate Legislation, the currently open list of organizational and legal forms of non-profit organizations has led to an unjustified increase in the number of types of non-profit organizations. Thus, the number of registered non-commercial organizations has already exceeded three times the number of established joint-stock companies.

The concept and features of a non-profit organization. In accordance with sp. 1 st. 50 of the Civil Code, a non-profit organization is a legal entity, not having as the main goal profit making and not distributing profits between participants.

Non-profit organizations can be created to achieve social, charitable, cultural, educational, scientific and managerial goals, protect the health of citizens, develop physical education and sports, satisfaction of spiritual and other intangible x needs of citizens, protection of rights and legitimate interests citizens and organizations, resolving disputes and conflicts, providing legal assistance, as well as for other purposes aimed at achieving public benefits (clause 2, article 2 of the Law on Non-Commercial Organizations).

The legislator points to two main features of non-profit organizations. The first is the lack of profit making as the main goal of the activity. The second is that the profit received cannot be distributed among the participants of a non-profit organization.

In reality, it is sometimes impossible to distinguish the main goal of a non-profit organization from the non-main one. Many non-profit organizations do not formally pursue profit as their main goal, but in fact seek and receive huge incomes from entrepreneurial activities.

The literature indicates the inconclusiveness of the well-known method of dividing legal entities into commercial and non-profit organizations. It is noted that the problem lies not so much in the choice of suitable criteria for delimitation, but in their consistent application to certain types of legal entities. An example of such inconsistency of the legislator is a consumer cooperative. According to paragraph 5 of Art. 116 of the Civil Code, income received by a consumer cooperative from entrepreneurial activities carried out by it in accordance with the law and the charter is distributed among its members.

The listed shortcomings of the concept of a non-profit organization force scientists and practitioners to look for alternative constructions of their isolation, for example, division into entrepreneurial (profitable) and non-entrepreneurial (non-profit) organizations.

Organizational and legal forms of a non-profit organization. Non-profit organizations can be created in the organizational and legal forms provided for by the Civil Code of the Russian Federation and other federal laws (clause 3, article 50 of the Civil Code). This means that the list of organizational and legal forms of non-profit organizations is not exhaustive.

The Civil Code of the Russian Federation names five organizational and legal forms of non-profit organizations: consumer cooperatives, public and religious organizations(associations), foundations, institutions, associations of legal entities(associations and unions). Special laws significantly expand this list of organizational and legal forms.

Law on non-profit organizations supplements the list with three forms of non-profit organizations: state corporation, non-profit partnership, autonomous non-profit organization.

Law on consumer cooperation names non-profit organizations as independent forms consumer societies and consumer unions.

Law of the Russian Federation of February 11, 1993 No. 4462-1 "Fundamentals of Legislation Russian Federation on notaries” regulates the activities of notary chambers.

Defines the status public organizations, movements, foundations, institutions, bodies of public initiative and political parties.

Federal Law of April 15, 1998 No. 66-FZ "About horticultural, horticultural and country non-profit associations of citizens” allows the creation of horticultural, horticultural and dacha non-profit partnerships.

Federal Law of May 31, 2002 No. 63-FZ "On advocacy and advocacy in of the Russian Federation” defines the status of bar associations, bar associations of constituent entities of the Federation and the Federal Chamber of Lawyers of the Russian Federation.

The Housing Code of the Russian Federation regulates legal status of homeowners' associations.

Special laws have been adopted in relation to chambers of commerce and industry, non-state pension funds, the Central Bank of the Russian Federation ( Bank of Russia), employers' associations, etc.

The organizational and legal form does not always reflect the commercial or non-commercial nature of the activities of a legal entity. For example, the form of a non-profit partnership seems to be quite close in nature to a limited liability company. At the same time, the form of a legal entity and the technical name of the organization should not be confused: exchange, commercial bank, center, etc. From this point of view, the stock exchange is not a legal form.

Legislation on non-profit organizations suffers from inconsistencies in relation to the organizational and legal forms of non-profit organizations.

So, by virtue of paragraph 2 of Art. 50 of the Civil Code, non-profit organizations can be created in the form of public organizations (associations). In its turn, Law on public associations(Article 7) differentiates the organizational and legal forms of public associations. Public associations can be created in one of the following organizational and legal forms: public organization; social movement; public fund; public institution; body of public initiative; Political Party.

It is no coincidence that the concept for the development of corporate legislation unequivocally states the need to establish in the Civil Code an exhaustive list of organizational and legal forms of non-profit organizations. One may disagree with such a proposal, but facts are stubborn things. In this part of the regulation, disorder is found.

Classification of non-profit organizations. Non-profit organizations can be classified according to various criteria:

1. by form of ownership;

2. founders' rights(participants) in relation to non-profit organizations or their property;

3. stock membership institution;

4. the presence of a foreign element;

5. territorial area of activity. Briefly consider the main types of organizations.

According to the form of ownership, non-profit organizations are divided into public(state and municipal institutions, state corporations, the Bank of Russia) and private (everyone else).

According to paragraph 2 of Art. 48 of the Civil Code, founders (participants) of a non-profit organization, as well as other legal entities, can have rights of obligation in relation to a non-profit organization or rights in rem rights to its property or not to have any property rights.

So, institutions and the Bank of Russia are not the owners of the property entrusted to them, the ownership right is retained by their founders. Members consumer cooperatives and non-profit partnerships acquire liability rights in relation to the non-profit organizations themselves, while losing the right of ownership to the transferred property. The founders have neither property nor liability rights foundations and autonomous non-profit organizations.

Organizational and legal forms of consumer cooperatives, associations of legal entities (associations and unions), homeowners associations, other organizations imply membership their participants (founders), whereas, for example, in foundations and autonomous non-profit organizations such an institution is excluded.

The presence (absence) of a foreign element and its size makes it possible to single out national non-profit organizations with foreign participation, as well as foreign non-profit organizations.

Depending on the territorial scope of activity, some non-profit organizations (for example, public organizations) can be divided into international, all-Russian, interregional, regional and local.

Legal capacity of non-profit organizations. All non-profit organizations have special legal capacity. They may carry out one or more activities, not prohibited by law and, we emphasize, consistent with the goals activities that are provided for by the founding documents.

Thus, according to general rule scope of special legal capacity of each non-profit organization depends on the will of its founders, who determine the goals and activities non-profit organization. In practice, when creating a non-profit organization, there is often no clear idea about all the future directions of its activities. For this reason, the founders tend to indicate the maximum list of goals and activities, sometimes reaching the point of absurdity.

Legislation provides commercial organizations with ample opportunities in terms of choosing the most effective behavior from the point of view of the purpose of entrepreneurial activity (making a profit). Such opportunities are provided by giving commercial organizations a number of freedoms, and above all, broad, practically unlimited legal capacity. For legal entities created not for profit, the ability to have any rights and assume any duties is not only unnecessary, but can be dangerous, because it creates potential conditions for evading them from the goals for which they were formed.

In addition, non-profit organizations are not professional members civil (let's add - entrepreneurial) turnover. Their performance as independent legal entities due primarily to the need for material support for the main activity, not connected Anna with the implementation of entrepreneurship.

The right of non-profit organizations (as well as commercial ones) to carry out activities for which a license is required arises from the moment such a license is received or within the period specified in it and terminates upon the expiration of its validity period, unless otherwise provided by law or other legal acts.

According to paragraph 3 of Art. 50 of the Civil Code, non-profit organizations have the right to engage in entrepreneurial activities with the obligatory observance of two requirements: a) such activities must serve the achievement of the goals for which they were created; b) the nature of the activity should correspond to these goals.

Incomes received as a result of entrepreneurial activities are directed to achieve the goals provided for by the constituent documents of a non-profit organization. We must agree that in modern conditions no legal entity can exist only on the contributions of the founders and donations. The profit received as a result of entrepreneurial activity is used by a non-profit organization to cover the costs associated with the non-entrepreneurial activity for which it was formed.

Developing the provisions of the Civil Code of the Russian Federation, the Law on Non-Commercial Organizations establishes that the entrepreneurial activity of a non-commercial organization is the profitable production of goods and the provision of services that meet the goals of creating an organization, as well as the acquisition and sale of securities, property and non-property rights, participation in business companies and partnerships on faith as a contributor (paragraph 2 of article 24). Non-profit organizations in the interests of achieving the goals stipulated by their constituent documents have the right to create other non-profit organizations and join associations and unions (clause 4, article 24 of the Law).

The law may provide for restrictions on the types of activities that non-profit organizations are entitled to engage in, including regarding the implementation of entrepreneurial activities (paragraphs 1.2, article 24 of the Law on Non-Commercial Organizations).

This rule corresponds with the norms of paragraph 3 of Art. 55 of the Constitution of the Russian Federation and paragraph 2 of Art. 1 of the Civil Code, establishing that civil rights may be restricted on the basis of federal law and only to the extent necessary to protect the foundations of the constitutional order, morality, health, rights and legitimate interests of others, to ensure the defense of the country and the security of the state. All legal restrictions on the entrepreneurial activities of non-profit organizations should be divided into two main groups: direct and indirect.

Direct restrictions imply the existence of clear regulatory prohibitions. For example, in accordance with paragraph 5 of Art. 9 of the Federal Law of July 11, 2001 No. 95-FZ “On Political Parties”, the activities of political parties and their structural divisions in public authorities and local self-government bodies (with the exception of legislative (representative) bodies), the interference of political parties in the educational process of educational institutions is prohibited.

Indirect restrictions, as a rule, exclude the possibility of non-profit organizations to perform certain actions (activities) by indicating an exhaustive list of other subjects of the relevant relations. So, non-profit organizations cannot be participants in general partnerships and general partners in limited partnerships (clause 4 of article 66 of the Civil Code), a party to a commercial concession agreement (clause 3 of article 1027 of the Civil Code) and a simple partnership concluded for entrepreneurial activities ( item 2 of article 1041 of the Civil Code). The activity of non-profit organizations as a financial agent under a financing agreement against the assignment of a monetary claim is excluded (Article 825 of the Civil Code), as well as credit institution(Article 1 of the Law on Banks and Banking), etc.

Non-Profit Organizations is not entitled to make transactions that are contrary to the purposes and types their activities. Such transactions are void. on the basis of Article 168 of the Civil Code, and in some cases may serve as a reason for its forced liquidation(Clause 2, Article 61 of the Civil Code).

5. The Russian Federation, its constituent entities, municipalities, state authorities and local self-government in business legal relations.

Like individuals and legal entities, the starting point of the entrepreneurial legal personality of the state and municipalities is their status as subjects of civil law. At the same time, it should be emphasized that they do not use any prerogatives, benefits, etc. in civil legal relations compared to other “non-powerful” participants. The updated Russian legislation consistently stands on the position of inadmissibility of any confusion of the functions of the state as a power political organization expressing, representing, protecting the interests of the Russian people and acting on behalf of the people, with its participation as a partner in civil circulation, market relations. The Russian Federation, subjects of the Russian Federation: territories, regions, cities of federal significance, autonomous regions, autonomous districts, as well as urban, rural settlements and other municipalities, says paragraph 1 of Art. 24 of the Civil Code of the Russian Federation, act in relations regulated by civil law, on an equal footing with other participants in these relations - citizens and legal entities.

An essential feature of the state and municipalities as subjects of civil legal relations is that the possibility of being a party to such relations is not conditional on their status as a legal entity. The rules governing the participation of a legal entity in relations regulated by civil law apply to them by virtue of the very fact of entering into these relations. However, the state and municipalities themselves cannot enter into civil legal relations. The Russian Federation, any of its subjects are represented by many structural units, starting with presidents, heads of administrations, etc. A municipal entity, in accordance with Part 1 of Art. 131 of the Constitution of the Russian Federation and art. 1 of the Federal Law of August 28, 1995 No. 154-FZ "On the General Principles of Organization of Local Self-Government", there is an urban, rural settlement, several settlements, united common territory, part of the settlement, other populated territory within which local self-government is exercised. Sukhanov E.A. Legal bases of business. - M.: Publishing house BEK, 2000. S. 5-39.

So who has the right to represent them in public relations regulated by civil law? The current legislation provides for two options for the possible participation of the state and municipalities in civil rights about relations.

Firstly, on behalf of the Russian Federation and the subjects of the Federation, as well as municipalities, they can, by their actions, acquire and exercise property and personal non-property rights and obligations, appear in court, respectively, state authorities and local self-government bodies within their competence established by acts defining the status of these bodies. For example, the President of the Russian Federation and the chambers of the Federal Assembly of the Russian Federation can act in the civil law sphere on the basis of the relevant provisions of the Constitution of the Russian Federation, the Government of the Russian Federation - on the basis of the Constitution of the Russian Federation and the Federal Constitutional Law "On the Government of the Russian Federation", etc.

No restrictions have been established for state bodies and local self-government bodies to participate in relations regulated by civil law. Only one thing is important: they can and should act only within the limits of their competence. This circumstance gives reason to assert that these bodies have special legal capacity. Transactions concluded by them with deviation from the established competence may be declared invalid.

It is necessary to emphasize the importance for the normal functioning of market relations and, as an example for other participants in civil law relations, the steady fulfillment by the Russian Federation, its constituent entities and municipalities of their obligations. To be condemned, in particular, are the attempts of certain heads of executive power of the constituent entities of the Federation, who were elected to this position for the first time, to refuse to pay off the debts left over from the previous administration.

By such behavior, the subjects of the Russian Federation discredit themselves as participants in civil law relations. But it's not only that. Such a position of the heads of the constituent entities of the Russian Federation can give rise to a situation comparable to the insolvency (bankruptcy) of economic entities. In the Budget Code of the Russian Federation, paragraph 1 of Art. 112 "Exceeding the limits of expenses for servicing the state or municipal debt" establishes: if, during the execution of the budget of a constituent entity of the Russian Federation, the costs of servicing the public debt of a constituent entity of the Russian Federation exceed 15% of its budget expenditures, and also in case of exceeding the maximum amount of borrowed funds established by Art. 111 of the Budget Code of the Russian Federation, and at the same time the constituent entity of the Russian Federation is not able to ensure the servicing and repayment of its debt obligations, the authorized body of state power of the Russian Federation may transfer the execution of the budget of the constituent entity of the Russian Federation under the control of the Ministry of Finance of the Russian Federation. If a municipal formation finds itself in a similar position, then the execution of the local budget may be transferred under the control of the body executing the budget of the constituent entity of the Russian Federation.

Secondly, in cases and in the manner provided for by federal laws, decrees of the President of the Russian Federation and resolutions of the Government of the Russian Federation, regulations of the constituent entities of the Russian Federation and municipalities, state bodies, local self-government bodies, as well as legal entities can act on their behalf on special instructions and citizens.

As subjects of civil law, the state and municipalities through their competent authorities enter into a variety of relationships. For example, the state and municipalities can be heirs by law and by will. Naturally, they can bequeath their property to them individual entrepreneurs. There are also extensive contractual and non-contractual relations with the participation of the state and municipalities. Thus, local governments, in accordance with the legislation of the Russian Federation, have the right to issue municipal loans and lotteries, receive and issue loans. Damage caused to a citizen or legal entity as a result of illegal actions (inaction) of state bodies, local self-government bodies or officials of these bodies, including as a result of a publication that does not comply with the law or other normative document act of a state body or local government. The harm shall be compensated at the expense of the treasury of the Russian Federation, the treasury of the subject of the Russian Federation or the treasury of the municipality, respectively.

The participation of the state and municipalities in entrepreneurship is regulated in a completely different way. They clearly distinguish at least three areas of entrepreneurial activity. Shitkina I.S. Entrepreneurial activity of non-profit organizations.// Citizen and law. 2002. No. 4.

The first is participation in entrepreneurial activity through commercial and non-commercial organizations that are being created. There are three types of such organizations. These are, first of all, state and municipal unitary enterprises, to which property belongs on the basis of the right of economic management. Its owners, i.e. the state and municipalities, approve the charter of the enterprise, appoint its head and conclude a contract with him, determine the subject and goals of the enterprise, exercise control over the intended use and safety of the property belonging to the enterprise, have the right to receive part of the profit from the use of the property.

The other two types are state-owned enterprises and institutions, to which the property is assigned on the right of operational management. Property owners have the right to confiscate excess, unused or misused property and dispose of the confiscated property at their own discretion. The owner determines the procedure for distributing the income of the state-owned enterprise. If an institution, in accordance with the constituent documents, has been granted the right to carry out income-generating activities, then the income received from such activity and the property acquired at the expense of these incomes shall be at the independent disposal of the institution and recorded on a separate balance sheet.

The second direction of entrepreneurial activity is participation in the management of privatized state and municipal property. Let us dwell on the activities of representatives of the Russian Federation, its subjects and municipalities in the management bodies of open joint-stock companies, the shares of which are fixed in state or municipal ownership. Representatives may be appointed by state or municipal employees, as well as other persons who carry out their activities on the basis of a regulation approved by the Government of the Russian Federation. When using a special right - a "golden share" - representatives are appointed to the board of directors (supervisory board) and audit commission. Sukhanov E.A. Legal bases of business. - M.: Publishing house BEK, 2000. S. 5-39.

Representatives act on the basis of the Decree of the President of the Russian Federation dated June 10, 1994 No. 1200 “On certain measures to ensure government controlled economy”, resolutions of the Government of the Russian Federation and other authorities that empowered them. On May 21, 1996, the Government of the Russian Federation adopted Decree No. 625 “On ensuring the representation of the interests of the state in the management bodies of joint-stock companies (economic partnerships), some of the shares (shares, contributions) of which are fixed in federal property". The Decree approved the Model Agreement for the Representation of the State's Interests in the Said Commercial Organizations and the Procedure for Concluding and Registering These Agreements. Attention should be paid to the requirements for vocational training and qualifications of persons who

Legal entities are business entities. In accordance with Art. 48 of the Civil Code of the Russian Federation, a legal entity is an organization that owns, manages or manages separate property and is liable for its obligations with this property, can acquire and exercise property and personal non-property rights on its own behalf, incur obligations, be a plaintiff and defendant in court . Legal entities must have an independent balance sheet or estimate. A legal entity is considered established from the moment of its state registration in in due course. A legal entity has its own name, containing an indication of its organizational and legal form. Depending on the organizational and legal form, legal entities act on the basis of the charter, or the constituent agreement and the charter, or only the constituent agreement.

In accordance with Art. 50 of the Civil Code of the Russian Federation legal entities are divided into two types: commercial and non-commercial organizations.

A commercial organization is an organization that sets profit as the main goal of its activities. In accordance with the procedure established by law and constituent documents, a commercial organization distributes net profit among the founders (participants). Consequently, in accordance with civil law, all commercial organizations (except for state-owned enterprises) can be considered entrepreneurial. Commercial organizations can be created in the form of economic partnerships and companies, production cooperatives, state and municipal unitary enterprises.

A commercial organization is a legal entity that has the main goal of making a profit (as opposed to non-profit). They can be created as economic partnerships and companies, production cooperatives, state and municipal unitary enterprises.

Legal entities that are commercial organizations can be created in the form of economic partnerships and companies, production cooperatives, state and municipal unitary enterprises. Legal entities that are non-profit organizations may be created in the form of consumer cooperatives, public and religious organizations, associations (associations, unions) of legal entities, institutions and in other forms provided for by law.

Legal entities that are commercial organizations must have a company name; under this name, a commercial organization is registered, entered in the state register of legal entities and enters into economic circulation.

A trade name is a way of individualization of a commercial organization, a commercial organization has the exclusive right to use it.

The current legislation also provides for other ways of individualizing commercial organizations: a trademark, a service mark, which are used to individualize homogeneous goods and services, as well as to advertise them. Trademarks and service marks are subject to registration. Registration as trademarks and service marks of designations containing information that may mislead consumers is prohibited.

The rights to the trade name, trademark and service marks are non-property rights and belong exclusively to this commercial organization. A commercial organization has the right to demand through an arbitration court the compulsory termination of the use by any other person of identical and similar forms of individualization, as well as compensation for losses caused by such a violation.

The law provides for various types of commercial organizations, in particular, they are divided into organizations that are owners of the property they use and are not. The former include business partnerships and companies, production cooperatives, the latter - state and municipal unitary enterprises.

Commercial organizations that own property, in turn, are divided into "associations of persons" and "associations of capital".

"Association of persons" are production cooperatives (artels); in these commercial organizations, personal participation in the activities of the cooperative is fundamental; this is manifested both in the management of the cooperative and in the distribution of profits. Each member of the cooperative, regardless of the size of its capital, has one vote at the general meeting, the distribution of profits is also carried out based on personal labor contribution.

Some personal participation in the activities of a commercial organization also involves a general partnership and a limited partnership (for general partners).

When considering the status of a legal entity, the question of its legal capacity is important. It can be general (universal) and special (target). Commercial organizations, with the exception of state and municipal unitary enterprises, have general legal capacity. Currently, they can engage in any type of entrepreneurial activity not prohibited by law. Non-commercial organizations, as well as state and municipal unitary enterprises, have special legal capacity. They have the right to engage only in those activities that are provided for by their constituent documents. These innovations are provided for by the Civil Code of the Russian Federation of 1994; in accordance with the previous legislation, commercial organizations had special legal capacity, could only engage in those types of activities that were provided for by their constituent documents. However, the founders of commercial organizations may, on their own initiative, limit the legal capacity of a legal entity by introducing appropriate provisions into the constituent documents. In this case, the activity of a legal entity must be carried out taking into account the established and restrictions.

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Posted on http:// www. all best. en/

INTRODUCTION

1.1 The concept and goals of entrepreneurship

2.1

2.2 Basics of building an organizational structure, types of commercial organizations

CONCLUSION

APPS

INTRODUCTION

The legal foundation for modern Russian entrepreneurship was laid in 1991 with the entry into force of the Law of the RSFSR “On Enterprises and Entrepreneurial Activity”. The Constitution of the Russian Federation, adopted in 1993, contains the criteria by which it is necessary to implement legal regulation economic, including entrepreneurial, activities. In particular, art. 34 of the Constitution of the Russian Federation establishes: every citizen has the right to free use of his abilities and property for entrepreneurial and other purposes not prohibited by law. economic activity.

The market economy was formed on the basis of individual property and is inconceivable without it. However, over time, this form of ownership has undergone significant changes.

Russia's economic development in last years made significant progress along the path of forming a polysubjective structure of property relations. As a result of the implementation in recent years of a wide range of measures for denationalization and privatization in Russia, there have been significant changes in property relations and organizational and legal forms. commercial activities.

The current situation is characterized by:

Overcoming the monopoly of state property in practically all spheres of the national economy;

Variety of forms of ownership;

Approval of new forms of organization of economic activity (joint stock companies, partnerships, charitable and other public funds, etc.).

The new situation required radical changes in the legal basis of economic activity. The Civil Code of the Russian Federation is the most important stage of the ongoing legal reform in Russia. He defined the fundamentals economic relations during the transition to market methods of management, he formed the basic rules, the norms of their legal regulation, generalized and legally consolidated the new forms of organization of economic life that have arisen in recent years.

Since entrepreneurship became possible in Russia, a huge number of different enterprises have already been formed and are being formed at the moment. They differ in many ways, but the fundamental factor that makes it possible to distinguish one enterprise from another is its organizational and legal form, sometimes the name legal form is used.

Radical update economic structures in Russia, aimed at expanding the capabilities of commercial organizations and realizing their entrepreneurial potential through the use of various forms and methods of management, determined the relevance of the topic of commercial organizations as a business entity.

The purpose of this term paper- study of commercial organizations as a business entity.

This goal involves the solution of the following tasks:

To study the concept of entrepreneurship;

Explore the goals of entrepreneurship;

Consider the types and forms of entrepreneurship;

To study commercial organizations as business entities.

CHAPTER 1. ENTREPRENEURSHIP: CONCEPT, GOALS AND TYPES

1.1 The concept and goals of entrepreneurship

In microeconomics, the entrepreneur plays the leading role.

The scientist-economist who developed one of the first concepts of entrepreneurship is Richard Cantillon (1680-1734), by definition of which an entrepreneur is a person acting in conditions of risk. It can be argued that Cantillon is the ancestor of the thesis about the entrepreneur as an economic entity that assumes the obligation to bear various risks due to the uncertainty of the outcome of economic activity.

A. Smith made a significant contribution to the development of the theory of entrepreneurship. An entrepreneur, according to Smith, is an owner of capital who, in order to implement some kind of commercial idea and make a profit, takes economic risks.

Entrepreneurial profit is, according to Smith, compensation to the owner for the risk. The entrepreneur himself plans, organizes production, realizes the benefits associated with the division of labor, and also manages the results of production activities.

Later, the famous French economist J.B. Say (1767-1832) in the book "Treatise on political economy» (1803) formulated the definition of entrepreneurial activity as a combination, a combination of three classical factors of production - land, capital, labor. An entrepreneur, he believes, is a person who undertakes at his own expense and risk and in his own favor to produce some kind of product Entrepreneurship / ed. V.Ya.Gorfinkel, G.B.Polyak.- M., 2010.- P.10.

D. Riccardo saw in capitalism an absolute, eternal, natural mode of production, and considered entrepreneurial activity as obligatory element effective management.

As Lapusta M.G. notes, the conclusion of economists of the 18th-19th centuries was of paramount importance for the development of modern entrepreneurship. that an entrepreneur is the owner of capital, the owner of his own business, managing it, often combining, especially at the first stage of the functioning of his own capital (business), the functions of the owner with personal productive labor Lapusta M.G. Entrepreneurship. - M., 2010. - P.19.

The concepts of "business" and "entrepreneurship" in the literature are in the same row. They mean economic activity that is carried out by individuals (private) or legal entities (enterprises or organizations / companies) and is aimed at making a profit by creating and selling products or services with the efficient use of resources. Entrepreneurs are able and should take risks and take financial, legal and social responsibility for the business that brings them profit.

Entrepreneurship refers to the activities carried out by individuals, enterprises or organizations for the production, provision of services or the purchase and sale of goods and exchange for other goods or money for mutual benefit. stakeholders or enterprises, organizations Entrepreneurship / ed. V.Ya.Gorfinkel, G.B.Polyak.- M., 2010.- P.13.

Article 2 of the Civil Code of the Russian Federation gives a legal definition of entrepreneurial activity: “Entrepreneurial activity is an independent activity carried out at one’s own risk, aimed at systematically making a profit from the use of property, the sale of goods, the performance of work or the provision of services by persons registered in this capacity in the manner prescribed by law” Article 2 of the Civil Code of the Russian Federation.

To generate sustainable profits, an entrepreneur must offer new products or services or develop more efficient production methods, finance the business, and sell products at a price that exceeds cost. Achieving this goal requires entrepreneurs to be willing to combine personal and public interests and, in particular, the interests of consumers, who can choose from more and better products and services in a competitive environment.

Entrepreneurship is a fundamentally new type of management, which is based on the innovative behavior of the owners of the enterprise, on the ability to find and use ideas, and translate them into specific entrepreneurial projects. This is usually a risky business, but one who does not take risks cannot, in the end, succeed. However, risk is different. An entrepreneur, before deciding to create his own business, must make calculations, study the intended sales market and competitors, while not neglecting his own intuition.

For the first time, the most complete definition of the essence of the concept of entrepreneurial activity was formulated in the Law of the RSFSR "On enterprises and entrepreneurial activity" (1990). This Law, in our opinion, most clearly formulated the rights, duties and responsibilities of entrepreneurs, as well as guarantees to them from the state.

Asaul A.N. notes that entrepreneurship is usually defined as:

As an activity aimed at maximizing profits;

The initiative activity of entrepreneurs, which consists in the production of goods and the provision of services, the result of which is profit;

The process of organizational innovation;

Direct function of realization of property;

Actions aimed at increasing capital and developing production;

A specific type of activity aimed at the tireless search for changes in the existing forms of life of enterprises and society, the constant implementation of these changes;

How is the style of management;

The process of organizing and implementing activities in a market environment;

Interaction of market subjects, etc. Asaul A.N. Organization of entrepreneurial activity - SPb., 2009.- P.17.

The legal foundation of entrepreneurship in Russia currently consists of the following legislative acts:

The Constitution of the Russian Federation of December 12, 1993, which guarantees the unity of the economic space, the free movement of goods, services and financial resources, support for competition, freedom of economic activity, recognition and protection equally of private, state, municipal and other forms of ownership.

The Civil Code of the Russian Federation unifies the legal regulation of market relations, fixes the basic principles of civil law regulation, ensures the inviolability and equality of protection of all forms of ownership, and guarantees the development of types of entrepreneurial activity that do not contradict the law.

Federal laws of the Russian Federation for special purposes: “On Joint Stock Companies” dated December 26, 1995 No. 202-FZ; "On non-profit organizations" dated January 12, 1996 No. 7-FZ; "On production cooperatives" dated May 8, 1996 No. 41-FZ; “On Limited Liability Companies” dated February 8, 1998 No. 14-FZ.

Federal Laws of the Russian Federation general purpose: "On State Support for Small Business in the Russian Federation" dated May 12, 1995; “On Competition and Restriction of Monopolistic Activity in Commodity Markets” dated March 22, 1991; "On investment activity" dated 06/26/1991; "On Foreign Investments" dated 04.07.1991; other federal laws, presidential decrees, government decrees, regulations federal and local authorities.

Part one of the Civil Code of the Russian Federation states that civil legislation regulates relations between persons engaged in entrepreneurial activities, or with their participation.

As Asaul A.N. notes, the goal is an ideal mental anticipation of the result of entrepreneurial activity. Asaul A.N. Organization of entrepreneurial activity. - St. Petersburg, 2009. - P.37.

It is an object of aspiration, a preconceived final plan,

the expected outcome of the entrepreneur's action. Ancestor strategic planning and management I. Ansoff defines the goal as a criterion for the success or failure of an entrepreneur.

Goals guide and regulate entrepreneurial activity, since it is entirely aimed at achieving them.

The processes of setting and achieving goals for entrepreneurs constantly replace each other.

A new goal for an entrepreneur is a stimulating factor. However, most entrepreneurs need recognition for their success and are able to take full blame for failures.

The main issue that an entrepreneur must resolve is to determine the goals of his entrepreneurial activity.

The main goal of the entrepreneur is to maximize his ability to satisfy the complex of socio-economic needs of the entrepreneur in the face of uncertainty, which is concretized under the influence of external environment based on the possibilities internal environment and from his past, as well as from the functions performed by the entrepreneurial unit. The goals of entrepreneurs depend on the external environment, and vice versa, the choice of the external environment by the entrepreneur occurs depending on the goals.

1.2 Types and forms of entrepreneurship

Entrepreneurial activity may include property relations of a different nature, approaches to organization and management, which requires their appropriate legal registration. Therefore, in practice, entrepreneurial activity is carried out in specific economic and legal forms. In the Russian Federation, the structure of economic and legal forms is determined by the Civil Code of the Russian Federation.

In accordance with the Civil Code (Civil Code of the Russian Federation), business entities can be business entities represented by both legal and natural (private) persons.

Yu.F. Simionov notes that all participants in entrepreneurial activity are divided by legal status into individuals and legal entities, and by purpose of activity - into commercial and non-profit organizations (Figure 1. APPENDIX 1) Economics / edited by Yu.F. Simionova.- Rostov n / D., 2008.- P.121.

Citizens who carry out entrepreneurial activities without forming a legal entity under their own property responsibility are classified as natural persons. This group of persons is represented by individual entrepreneurs and peasant farms.

Organizations are recognized as legal entities, including those created by individual citizens, which have separate property, an independent balance sheet, can acquire property and non-property rights and are liable with their property for the obligations arising in relation to them. Legal entities are differentiated according to the purpose of their activity into commercial and non-commercial organizations.

A commercial organization is an entrepreneurial entity pursuing profit making as the main goal of its activities. A non-profit organization is an entity that does not have profit making as the goal of its activities and does not distribute the profit received among the participants. It can be represented by public and religious organizations, institutions, consumer cooperatives and charitable foundations, various unions and associations of legal entities.

Business partnerships and companies are commercial organizations with authorized (reserve) capital divided into shares (contributions) of founders (participants). Business partnerships can be created in the form of a general partnership and a limited partnership (limited partnership).

A partnership is recognized as a full one, the participants of which (general partners), in accordance with the agreement concluded between them, are engaged in entrepreneurial activity on behalf of the partnership and are liable for its obligations with their property.

A limited partnership (limited partnership) is a partnership in which, together with the participants who carry out entrepreneurial activities on behalf of the partnership and are liable for the obligations of the partnership with their property, there are one or more participants-depositors (limited partners) who bear the risk of losses associated with activities of the partnership, within the limits of the amounts of contributions made by them and do not take part in the implementation of entrepreneurial activities by the partnership.

A limited liability company is founded by one or more persons. The authorized capital is divided into shares, which are determined in the memorandum of association.

An additional liability company is established by one or more persons, the authorized capital of which is divided into shares determined by the founding documents.

A joint stock company is a company whose authorized capital is divided into a certain number of shares. The participants in a joint stock company are not liable for its obligations and bear the risk of losses associated with the activities of the company to the extent of the value of their shares.

Subsidiaries and dependent companies. A business company is a subsidiary if the main business company with a predominant participation in the authorized capital has the ability to determine the decisions made by such a company.

A production cooperative is a voluntary association of citizens on the basis of membership for joint production activities.

A unitary enterprise is a commercial organization that is not endowed with the right of ownership of the property assigned to it by the owner. The property of a unitary enterprise is indivisible. Only state or municipal enterprises can be unitary.

Consider commercial organizations as a business entity in more detail.

CHAPTER 2. COMMERCIAL ORGANIZATIONS AS A BUSINESS SUBJECT

2.1 Types of commercial organizations

According to Asaul A.N., according to the degree of entrepreneurial activity, in accordance with Russian legislation, organizations are divided into two groups: commercial and non-commercial Asaul A.N. Organization of entrepreneurial activity - SPb., 2009.- P.85. The adjective "commercial" means that the organization is economically (monetarily) motivated social organization which has the main goal of making a profit. Legal entities that do not have profit making as the main goal of their activities and do not distribute profits among participants are non-profit organizations.

A commercial organization (company) may include more than one enterprise (single property complex) carrying out entrepreneurial activities within the organization (company), but several.

According to paragraph 2 of article 50 of the Civil Code of the Russian Federation, commercial - organizations that pursue profit as the main goal of their activities; Entrepreneurship is their main core of the Civil Code of the Russian Federation Art.50.

Commercial organizations are divided into three major categories: organizations that unite individual citizens (individuals); organizations that combine capital and state unitary enterprises (Figure 2. APPENDIX 2).

The former include business partnerships and production cooperatives. The Civil Code clearly distinguishes partnerships - associations of persons requiring the direct participation of founders in their activities, companies - capital associations that do not require such participation, but involve the creation of special management bodies. Business partnerships can exist in two forms: a general partnership and a limited partnership.

In a general partnership (PT), all its participants (general partners) are engaged in entrepreneurial activities on behalf of the partnership and are fully liable for its obligations. Each participant may act on behalf of the partnership, unless otherwise established by the memorandum of association. The profit of a full partnership is distributed among the participants, as a rule, in proportion to their shares in the share capital. For the obligations of a full partnership, its participants are jointly and severally liable with their property.

In a general partnership and limited partnership, shares of property cannot be freely assigned, all full members bear unconditional and joint and several liability for the liability of the organization (they answer with all their property).

Business companies may be created in the form of a joint stock company, a limited or additional liability company. In partnerships and societies, the means and efforts of their participants are combined to achieve a single economic goal. Partnerships are characterized by closer personal relationships of the participants; these are most often associations of persons in which the personal qualities of the participants are of decisive importance. In societies, in the foreground is the pooling of capital, and the personal qualities of the participants are not of decisive importance.

A production cooperative (artel) is a voluntary association of citizens for the joint conduct of entrepreneurial activities on the basis of their personal labor and other participation, the initial property of which consists of shares of members of the association bearing subsidiary liability for all its obligations in the manner and in the amount established by the charter and legislation on production cooperatives (Article 107 of the Civil Code of the Russian Federation).

By the time of state registration, at least 10% of the unit fund of the cooperative must be paid. The rest is paid during the first year of operation production cooperative.

Citizens, legal entities (if it is provided for by the charter) can be participants in a cooperative. The number of members of a production cooperative may not be less than five. The number of members of the cooperative who do not take personal labor participation in its activities is limited to 25% of the number of members participating in the work of the cooperative by personal labor (Article 7 of the Federal Law "On Production Cooperatives").

The founding document of a production cooperative is the charter. The supreme governing body is the general meeting of members of the cooperative, which has exclusive competence.

Features of the legal status of a production cooperative are enshrined in the Civil Code of the Russian Federation, as well as in the Federal Law "On Production Cooperatives".

As Pereverzev M.P., Luneva A.M. note, the most common forms of organization in large and medium-sized businesses are joint-stock companies. The difference between joint-stock companies lies in the fact that they are granted the right to raise the necessary funds by issuing securities - shares Pereverzev M.P., Luneva A.M. Fundamentals of Entrepreneurship / Under the general. ed. M.P. Pereverzeva. - M, 2009. - P.27.

The legal status of a joint stock company is determined by the Civil Code of the Russian Federation, as well as the Federal Law "On Joint Stock Companies".

Authorized capital joint-stock companies is formed from a certain number of shares. The number and par value of shares is determined in the articles of association. At the same time, the participants of a joint-stock company are not liable for its obligations and are responsible for the results of its activities within the limits of the value of their shares. Most of these companies in Russia in the 1990s were created through the privatization of state or municipal enterprises. Privatization of state and municipal property - paid alienation of property (objects of privatization) owned by the Russian Federation, subjects of the Federation or municipalities into the ownership of individuals and legal entities.

A joint-stock company (JSC) is a company whose charter capital consists of the nominal value of the company's shares acquired by shareholders and, accordingly, is divided into this number of shares, and its participants (shareholders) bear material liability within the value of their shares. Joint-stock companies are divided into open and closed (JSC and CJSC). Members of an OJSC may alienate their shares without the consent of other shareholders, and the company itself has the right to conduct an open subscription for issued shares and their free sale. In a CJSC, shares are distributed by closed subscription only among its founders or other predetermined circle of persons, and the number of founders in Russian law is limited to 50 persons.

One of the types of commercial organizations are also state and municipal unitary enterprises, the legal status of which is determined by the Civil Code of the Russian Federation, as well as the Federal Law "On State and Municipal Unitary Enterprises".

State and municipal unitary enterprises (UE) include enterprises that are not endowed with the right of ownership to the property assigned to them by the owner. This property is in state (federal or subjects of the federation) or municipal property and is indivisible. There are two types of unitary enterprises (Table 1. APPENDIX 3) Asaul A.N. Organization of entrepreneurial activity - St. Petersburg, 2008. - P. 95:

1) based on the right of economic management (they have wider economic independence, in many respects they act as ordinary commodity producers, and the owner of the property, as a rule, is not liable for the obligations of such an enterprise);

2) based on the right of operational management (state-owned enterprises) - in many respects they resemble enterprises in a planned economy, the state bears subsidiary responsibility for their obligations if their property is insufficient.

The charter of a unitary enterprise (UE) is approved by the authorized state (municipal) body and contains:

The name of the enterprise indicating the owner (for a state enterprise - indicating that it is a state enterprise) and location;

The procedure for managing activities, the subject and goals of activities;

The size of the authorized fund, the procedure and sources of its formation.

The authorized capital of the UE is fully paid by the owner before state registration. The amount of the authorized capital is not less than 1000 minimum monthly wages as of the date of submission of documents for registration.

If the value of net assets at the end of the financial year is less than the size of the statutory fund, then the authorized body is obliged to reduce the statutory fund, about which the enterprise notifies creditors.

Unlike commercial legal entities - owners of property (economic partnerships, companies and production cooperatives), state and municipal enterprises:

They manage not their own property, but state or municipal property;

They do not have the right of ownership, but limited real rights (the right of economic management, the right of operational management);

Are endowed with special (rather than general) legal capacity;

They are unitary, since their property cannot be distributed among contributions (shares, shares).

The Russian Federation creates and operates the following types unitary enterprises:

1) unitary enterprises based on the right of economic management:

Federal State Enterprise;

State enterprise of a constituent entity of the Russian Federation (state enterprise);

Municipal enterprise;

2) unitary enterprises based on the right of operational management:

Federal state enterprise;

State enterprise of the subject of the Russian Federation;

Municipal government enterprise.

State-owned enterprises differ from other state and municipal enterprises in that:

Are endowed with a real limited right of operational management, while other state-owned enterprises have the right of economic management; entrepreneurship organizational commercial cooperative

The right of operational management is much narrower than the right of economic management;

Not entitled to independently dispose of not only immovable, but even movable property;

Unlike other state-owned enterprises, they cannot be declared bankrupt;

The state (the Russian Federation or a constituent entity of the Russian Federation) bears additional responsibility for their obligations if their property is insufficient;

They do not form an authorized fund, while in enterprises based on the right of economic management, such a fund is created (the size of the fund state enterprise cannot be lower than 5000 minimum dimensions wages, municipal - 1000 minimum wages) Smagina I.A. Entrepreneurial law - M., 2007 - P.19.

Municipal unitary enterprise.

The participant of the enterprise is its Founder - an authorized state body or local self-government body. This type of unitary enterprise is based on the right of economic management.

Constituent document - a charter approved by an authorized state body or local self-government body.

All decisions on the management of the enterprise are made by the head or another body appointed by the owner of its property.

By its obligations with all its property. Not responsible for the obligations of the founder. The owner of the property is liable for the obligations of the enterprise if its bankruptcy has occurred through the fault of the owner of the property.

The conditions for the use of profits are stipulated in the charter approved by the founder.

The liquidation of the enterprise is carried out by the decision of the founder - the owner of its property.

The enterprise may receive assistance from the state or local government. However, the management and other employees of the enterprise will not be sufficiently interested in effective work. SE, as a rule, are not able to compete with private enterprises.

2.2 Basics of building an organizational structure, types of commercial organizations

Any entrepreneur is obliged to create his own organizational structure and be able to professionally manage it. His focus will be on building an organizational structure. In the process of creating management of the organizational structure of an entrepreneurial organization, the entrepreneur personally manages the entire process. Although he can delegate management authority to a manager to some extent. In the future, in connection with the change in the goals and objectives that arise before the entrepreneur, the organizational structure entrepreneurial organization.

Asaul A.N. notes that it seems rational to consider the organizational structure at three levels of interaction: 1) "external environment - organization", 2) "division - division", 3) "individual - organization" Asaul A.N. Organization of entrepreneurial activity - St. Petersburg, 2009 .- P.116.

The mechanistic approach assumes the functioning of the organizational structure like a machine mechanism. In such an organization, the rules and procedures are extremely formalized, decision-making is centralized, and responsibility is narrowly defined. With these characteristics, an organization can operate effectively in a routine technology, uncomplicated and non-dynamic environment. This approach is often criticized, although its application is expedient in modern conditions.

The classification of organizational structures according to the method of interaction with the external environment into mechanistic and organic is the most terminologically correct.

From the point of view of the interaction of departments, the most traditional is a linear-functional organizational structure. The basis here is the linear divisions that carry out the main work in the organization and serve them with specialized functional divisions created on a “resource” basis: personnel, finance, plan, raw materials, etc.

The passage in the development of a modern organization of the stage of a linear-functional structure is mandatory. Regardless of the length of this stage in time, it is necessary, since "jumping" over it deprives the organization of the opportunity to work out the relationship "boss - subordinate". Only a linear-functional structure is capable of deploying an effective, mass, large-scale production.

In general, the divisional structure grows out of departmentalization based on some end result: product, consumer or market.

The transition to a divisional structure allows the organization to continue to grow and effectively manage different types activities in different markets.

Heads of departments within the framework of the product or territory assigned to them coordinate activities not only along the line, but also according to functions, developing the required qualities of general leadership. Thus, a good personnel reserve is created for the strategic level of the organization.

The divisional structure is especially effective where production is weakly subject to market fluctuations and depends little on technological innovations, since its construction is based on a mechanistic approach. If the mechanistic approach is replaced by an organic one, the divisional structure develops into a matrix one.

The matrix structure attracts leaders with a high potential for adapting to changes in the external environment by simply changing the balance between resources and results, functions and products, technical and administrative goals. This is the only structure with pronounced horizontal connections, which, in combination with vertical ones, implement the mechanisms of plurality of power and local decision-making. This state of affairs develops the abilities of employees and makes them participants in the decision-making process. At the same time, the matrix structure is difficult to implement, cumbersome and expensive to operate. Some experts call it the "managerial ideal" and are skeptical about it.

According to the level of interaction with a person, there are corporate and individualistic types of organizational structures.

A common mistake in this case, is a fuzzy distinction between the concept corporate organization as a special system of relations between people in the process of their interaction and a corporation as a form of a legal entity - a joint-stock company.

The corporate type of organization is closed groups of people with limited access to them from the outside, maximum authoritarian leadership and complete centralization of management. The corporation opposes itself to others social communities people based on their narrow interests. An example of a corporation is craft workshops and merchant guilds in the Middle Ages, trade unions and political parties, government ministries and departments, natural monopolies, and other large entities.

Through the pooling of resources, including human resources, the possibility of the existence of a particular social group, profession, caste is ensured. However, this unification occurs through the division of corporation participants according to social, professional, caste and other criteria. The interests of the "divided" people are coordinated by the leaders of corporations, which is the source of their power (the principle of "divide and rule").

In the course of its activities, the corporation strives to standardize its activities, to prevent internal competition by supporting the weak and limiting the strong. This is how the policy of egalitarianism manifests itself. The loyalty of the individual to the organization dominates, obedience and diligence are welcomed.

The subject of interest in a corporation is the organization itself. The priority of organizational goals over individual ones is established. An individual, having his own goals, desiring their realization, must support the goals of the corporation, ultimately identifying them with his own. The corporation takes responsibility for its members. As a result, the organization or all its members become above each individual, which puts him in a strong dependence and practically deprives him of independence.

The individualistic type of organization is directly opposite to the corporate one.

The structure has an organic basis and is constantly changing, informal and horizontal connections prevail.

A further development of the matrix structure along the path of an individualistic approach was a multidimensional structure. Orientation to the market and a specific consumer made it necessary to introduce, in addition to two dimensions of the matrix structure - resources (functions) and results (projects), the third dimension - servicing a specific consumer, developing or penetrating a specific market, conducting operations in a certain territory. The main advantage of this approach is the ability to satisfy the needs of the consumer as much as possible, bringing him as close as possible to the manufacturer. In addition, this approach solves the main problem of the matrix structure - the double subordination of workers.

In modern conditions, when it is necessary to quickly adapt to a rapidly changing business environment, the main competitive advantages are efficiency and flexibility. The interaction between the organizational structure and modern information technology (IT) served as the basis for the creation of a new organizational structure - virtual.

The Virtual Organizational Structure (VOC) is built on the temporary interaction of several independent functional partners who manage the design, manufacture and sale of products using modern information technologies. One of its key features is the remote work of all parts of the business goal, coordinated with the help of modern means of telecommunications. Virtual team members exchange information and make collegial decisions online. At the same time, both internal resources of the company and external ones (including suppliers and consumers) are included in the scope of business cooperation.

CONCLUSION

Thus, having studied this topic, we can draw the following conclusions.

The variety of forms of ownership is the basis for the creation of various organizational and legal forms of organizations. According to the current Russian legislation, there are various organizational and legal forms of commercial organizations.

Depending on who owns the organization, the form of ownership is also determined. The legislation of the Russian Federation provides for the following forms of ownership: private, state, property of public organizations (associations) and mixed.

Commercial organizations are divided into three major categories: organizations that unite individual citizens (individuals); organizations that unite capital and state unitary enterprises. The former include business partnerships and production cooperatives. The Civil Code clearly distinguishes partnerships - associations of persons requiring the direct participation of founders in their activities, companies - capital associations that do not require such participation, but involve the creation of special management bodies. Business partnerships can exist in two forms: a general partnership and a limited partnership.

In a general partnership (PT), all its participants (general partners) are engaged in entrepreneurial activities on behalf of the partnership and are fully liable for its obligations.

A limited partnership, or a limited partnership (TV or CT), is recognized as such a partnership in which, along with general partners, there are also contributors (limited partners) who do not take part in the business activities of the partnership and bear limited liability within the limits of the amounts contributed by them deposits. In essence, TV (CT) is a complicated type of PT.