Target financial work consists in organizing the circulation of capital with financial resources and distributing them in an optimal way over different stages of the circulation.

The listed tasks have specific implementation mechanisms, their own rules and techniques, far from the rules and techniques. accounting. Although financial work is regulated by state-level regulations, the financial manager is more free in making management decisions.

Therefore, the following provisions are included in the responsibilities of the financial department:

ѕ drawing up tactical and operational plans for financing;

ѕ calculation and adjustment of the norms of working capital for individual items, elements, types of reserves and costs in general for the organization;

- identification of sources of financing, determination of volumes and sources of investments, formation of reserve funds and financial reserves of the enterprise;

ѕ consideration of prices for products manufactured by the organization, control over the use of funds, funds and reserves, the formation of financial and economic calculations, participation in the preparation of draft contracts, justification of forms of payment.

The financial department in its activities is closely connected with the economic, supply and marketing, technical and production services of the enterprise and, together with other departments, provides:

ѕ with the marketing service and sales department - preparation of planning documentation for deliveries finished products, development of prices, payment terms;

ѕ with the supply service - development of prices and delivery schedules, determination of the optimal order size and stocks, control over stocks of inventory items;

* with department capital construction- development of title lists of construction sites and facilities, plans for financing capital investments by the production services of the enterprise - participation in the development of norms, standards and consumption limits production resources, control over the remains of work in progress;

* with design and technological services - participation in the preparation of plans for research and development work, organization of funding;

ѕ with accounting - checking the correctness of the preparation of estimated and financial estimates, these audits and inventories.

Organization of financial work

Formation of financial work in an organization - in market conditions, the formation of correct work includes the goal of fulfilling obligations to budgets in a timely manner, own employees at the enterprise, other business entities, the credit system, as well as effective financial management - management.

The organization of financial work at the enterprise involves the optimization of management cash flows that arise in the course of financial economic activity, maximizing profits and improving the well - being of the owners of the enterprise .

Financial work at the enterprise, as a rule, is allocated to an independent service, its size is determined by the scale of activity and industry characteristics. For example, at large enterprises, holdings create financial directorates or financial institutions as independent structural units. The Head of Finance reports directly to to CEO(director) of the organization and together with him is responsible for the financial condition of the commercial organization. Usually CFO large enterprise has several functional financial works under its control, that is, structures (links): cash flow management, financial planning, raising borrowed funds and issuing securities, investing, risk management and insurance.

The organization of financial work in a medium-sized enterprise is concentrated in the financial department or is entrusted to a specialist in the field of financial management - a financial manager who is part of the functional economic unit. Financial work can also be performed by financial sectors as part of the planning and financial, financial and marketing, financial and accounting or other divisions of the enterprise. Functional structures for managing financial work in small enterprises, as a rule, are not created. Due to the insignificant volume of organization of financial work at the enterprise, the obligations for its execution are usually assigned to the owner of the enterprise, its director or accountant.

Regardless of the scale of activity, features of financial management at the enterprise, such work includes three areas: financial planning, operational work and control and analytical work. In its course, the following main tasks are solved:

* providing the necessary financial resources to replenish production and social development;

ѕ solution of problems to increase profits and increase profitability;

ѕ ensuring the fulfillment of one's own obligations to the budgets, employees of the enterprise (in terms of wages), suppliers, banks, etc.;

* determination of ways of efficient use of property, fixed assets and working capital;

* management investment activity and achieving maximum financial performance;

* organization of control over financial decisions, rational use of financial resources, safety of working capital .

Organization financial management at the enterprise helps the company survive in a competitive environment, ensure a stable financial position, maximize the "price" of the enterprise, profits, minimize costs, profitability, increase production and sales. The enterprise has the right to increase its own income through its core activities and be active in the stock market (securities market), take part in the activities of other enterprises and organizations, develop related areas of activity, use other financial work of the enterprise, where there is no contradiction to the law, all this is necessary in order to increase the overall financial result.

2. The financial service of the enterprise, its structure and relationship with others

divisions of the enterprise

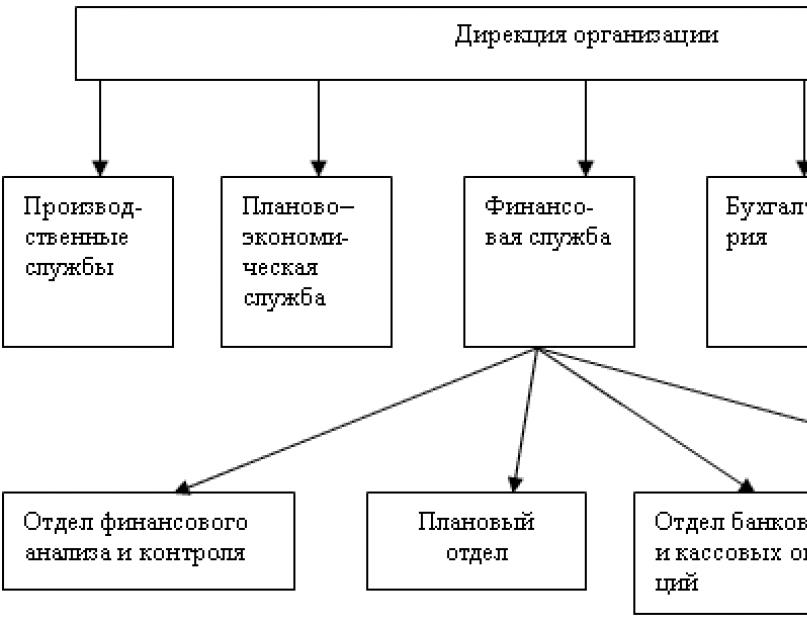

Financial service – an independent structural unit that performs certain functions in the enterprise management system (Fig. 2.4). Usually this unit is financial department. Its structure and number depends on the organizational and legal form of the enterprise, the nature financial activities, production volume, number of employees at the enterprise.

Rice. 2.4. The purpose and objectives of the financial service

The financial service performs numerous functions. The main ones are financial planning, the financial analysis, financial control and financial management. The functions of the financial service are built in full accordance with the content of financial work in enterprises (Fig. 2.5).

Rice. 2.5. Sample structure financial service

The financial service is part of a single business management mechanism, and therefore it is closely related to other services of the enterprise, and therefore it is closely related to other services of the enterprise.

So, as a result of close contacts with the accounting department, the financial service is presented with production plans, lists of creditors and debtors, documents on the payment of salaries to employees, the amounts of money in his accounts, and the amounts of forthcoming expenses. In turn, the financial service, processing this information, analyzing it, gives a qualified assessment of the solvency of the enterprise, the liquidity of its assets, creditworthiness, draws up a payment calendar, prepares analytical reports on other parameters of the financial condition of the enterprise and acquaints the accounting department with financial plans and analytical reports on their implementation. , which in its daily activities is guided by this information.

From the marketing department, the financial service receives plans for the sale of products and uses it in income planning and operational financial plans. To conduct a successful marketing campaign, the financial service justifies selling prices, approves a system of concessions in the price of the contract, analyzes sales and marketing costs, carries out a comparative assessment of the competitiveness of the company's products, optimizes its profitability, thus creating conditions for concluding large transactions (Fig. 2.6) .

The financial service has the right to demand from all services of the enterprise the actions necessary for the qualitative organization of financial actions and financial flows. In its competence are also such important characteristics of the enterprise as its image, business reputation.

Rice. 2.6. The relationship of the financial service of the organization with other departments

Like any management system, financial management consists of two subsystems: the object of management and the subject of management.

Rice. 2.7. Financial management system in an organization

The object of management in financial management is the cash flow of an economic entity, which is a flow of cash receipts and payments. Certain sources must correspond to each direction of spending money funds: in an enterprise, sources can include equity and liabilities that are invested in production and take the form of assets. In general, the constant process of cash flow is shown in Fig. 2.7.

The process of cash flow management largely consists in forecasting for the long term cash flow and assessing its impact on the financial condition of the enterprise.

The subject of management is the financial service, which develops and implements the strategy and tactics of financial management in order to increase the liquidity and solvency of the enterprise through the receipt and effective use of profits.

The specific structure of the financial service largely depends on the organizational and legal form of the enterprise, its size, the range of financial relations, the volume of financial flows, the type of activity and tasks set by the company's management. Therefore, the financial service can be represented by various formations (Fig. 2.8).

Rice. 2.8. Types of financial services depending on the size of the enterprise

The financial department of an enterprise usually consists of several bureaus responsible for separate directions financial work: planning bureau, banking operations bureau, cash operations bureau, settlement bureau. Special groups are created within each bureau. The functions of each group are determined as a result of detailing the functions of the bureau.

The financial management of the enterprise combines the financial department, the planning and economic department, the accounting department, the marketing department and other services of the enterprise.

These services report to the Vice President for Finance (Fig. 2.9).

Rice. 2.9. Organizational structure organization management

The concentration in the hands of one directorate of the main enterprise management services significantly increases the possibility of regulatory influence on financial relations and financial flows. In this case, the financial service not only successfully captures the quantitative parameters of the enterprise, but also, thanks to direct participation in the development of the financial strategy and tactics of the enterprise, largely determines their quality.

When determining the content of the work of the financial directorate (financial manager), it is important to note that it either represents a part of the work of the top management of the enterprise’s administrative apparatus, or is associated with the provision of analytical information to it, with which it is possible to make decisions in the field of finance.

The Directorate as a whole and each of its divisions operate on the basis of the Regulations on the Financial Directorate, approved by the management of the enterprise. It clearly reflects the general aspects of the organization and structure of the financial service, defines specific tasks and functions, relationships with other divisions and services of the economic entity; rights and responsibilities of the management. The tasks facing the financial directorate and its divisions cover all areas of the enterprise.

In the management of the financial activities of the enterprise, an important role is played by financial managers.

In his work, the financial manager is based on the current legislation in the tax, currency, financial and credit areas, proceeds from an assessment of the economic situation in the country and global financial markets. He is subordinate to two functional manager- Comptroller and Treasurer There are no clear distinctions in the work of the controller and the treasurer, they official duties different companies differ depending on the policies pursued by them, and personal qualities(Fig. 2.10).

Rice. 2.10. Functions of the controller and treasurer in the financial activities of the organization

The functions of the controller are primarily internal in nature. They consist in maintaining accounting records, tracking document flow and monitoring the financial results of activities for past and current business activities. The controller is, in fact, the chief accountant of the company and the management entrusts him with the preparation of financial reports, tax returns, and the annual report.

The activities of the treasurer are aimed at solving global issues to ensure financial stability companies. The treasurer manages the enterprise's capital entrusted to him, that is, he forms its optimal structure, evaluates capital costs, manages cash flow, attracts long-term and short-term loans, and organizes settlements with buyers.

The treasurer concentrates his efforts on maintaining the liquidity of the enterprise, receiving cash from obligations and increasing funds to achieve the company's goal. While the controller focuses on profitability, the treasurer emphasizes cash flow by managing the company's receivables and payments. By constantly dealing with these issues, the treasurer can see the signs of bankruptcy in time and warn him.

The financial manager is usually employed as employee under a contract that strictly defines its functional responsibilities, order and amount of wages. In addition to the salary, the financial manager, who belongs to the highest management apparatus, can receive remuneration in the form of a percentage of net profit based on the results of the enterprise's activities. Its size is determined supreme body management economic entity: meeting of shareholders, meeting of founders, board of the enterprise. In some countries (USA, Japan), chief financial managers own a stake in the company.

1. The financial department is an independent structural subdivision of the enterprise.

2. The department is created and liquidated by the order of the director of the enterprise.

3. The department reports directly to the commercial director of the enterprise.

4. Department management:

1.4.1. The department is headed by the head of the financial department, appointed to the position by order of the director of the enterprise upon presentation commercial director.

1.4.2. The head of the finance department has ______ deputy(s).

1.4.3. The duties of the deputy (s) are determined (distributed) by the head of the financial department.

1.4.4. Deputy(s) and leaders structural divisions as part of the financial department, other employees of the department are appointed to positions and dismissed by order of the director of the enterprise on the proposal of the commercial director and in agreement with the head of the financial department.

- Structure of the financial department

2.1. Composition and staffing of the financial department is approved by the director of the enterprise based on the conditions and characteristics of the enterprise's activities on the proposal of the commercial director and the head of the financial department and in agreement with

2.2. The department includes

2.3. The head of the financial department distributes duties among the employees of the department and approves their job descriptions.

- Tasks and functions of the financial department

|

No. p / p |

Task |

Functions |

|

3.1 |

Implementation of a unified enterprise policy in the field of finance |

Development of the financial strategy of the enterprise and the basis for its financial stability. Drafting of long-term and current financial plans, with the application of all necessary calculations. Participation in the development of proposals aimed at: Ensuring solvency; Prevention of the formation and liquidation of unused inventory items, excess stocks; Increasing the profitability of production; Increasing profit; reduction of production and sales costs. Implementation of measures to strengthen financial discipline at the enterprise. Compilation and submission to the management of the enterprise: Information about the receipt of funds; Reports on the progress of financial, credit and cash plans; Information about the financial condition of the enterprise; Development of the enterprise's monetary policy. Identification of possible financial risks, their assessment in relation to each source of funds. Development of proposals to reduce financial risks and insurance programs. Determination of the company's strategy in the field of leasing operations, the implementation of leasing financing. Participation within its competence in the consideration of issues related to the establishment of new enterprises, reorganization and liquidation of structural divisions of the enterprise. |

|

3.2 |

Organization of the financial activity of the enterprise with the aim of the most efficient use of all types of resources in the process of production and sale of products (works, services) and obtaining maximum profit. |

Management of the movement of financial resources of the enterprise and regulation of financial relations arising between business entities in order to most effectively use all types of resources. Preparation of materials for drawing up a business plan for the enterprise. Participation in the preparation of draft plans: sales of products (works, services), capital investments, scientific research and developments. Determination and implementation of investment policy, participation in the search for additional investment and financial resources. Determination of sources of financing of capital investments. Development and approval of the capital investment plan. Determining the procedure and conditions for financing capital or current repairs of fixed assets, drawing up proposals for attributing expenses to the cost of production. Ensuring timely receipt of income. Registration of financial settlement and banking operations in deadlines, including the presentation of payment requests, orders and other settlement documents to banks, receipt of documents for the shipment of products, invoice statements. Taking measures for the timely receipt of funds for shipped products (work performed, services rendered). Preparation necessary materials for mutual settlements. Development and implementation of measures that contribute to the timeliness of payments, the choice of forms of settlement with counterparties and ensuring compliance with the rules for conducting settlements. Ensuring financing of expenses provided for by financial plans, capital investment plans. Bringing the indicators of financial plans and the tasks arising from them to the structural divisions of the enterprise. Implementation of control over the implementation of financial plans by structural units. Ensuring the implementation of financial, credit and cash plans. Control for: Fulfillment of financial plans and budget, product sales plans, credit and cash plans, profit plans and other financial indicators; Termination production, not having a market; Correct and efficient use of funds; Target use of own and borrowed working capital for structural divisions and for the enterprise as a whole; Compliance with cash discipline; the correctness of the preparation, execution and approval of estimates, calculations of the payback of capital investments. Analysis of the production, economic and financial activities of the enterprise, forecasting the results of the financial and economic activities of the enterprise. Providing departments of the enterprise with instructive materials related to the financial activities of the enterprise. Ensuring the protection of information resources (own and received from other organizations) containing restricted access information. |

|

3.3 |

Control and management of used working capital of the enterprise, loans. |

Participation in planning the cost of production and profitability of production. Development of forecasts of expected profit, calculation of income tax, preparation of profit distribution plans for the year and quarters. Determining the need for own working capital and calculating the norms of working capital, planning measures to accelerate their turnover. Work on finding own funds and attracting borrowed funds. Determining the amount of expenses for the payment of dividends on the company's shares. Management of enterprise assets, determination of their optimal structure, preparation of proposals for the replacement, liquidation of assets. Ensuring timely payment of invoices of suppliers and contractors for shipped material assets (work performed, services rendered) in accordance with the concluded agreements. |

|

3.4 |

Analysis of the financial and economic state of the enterprise. |

Development of forecast balances and cash budgets. Maintaining operational records of financial, settlement and credit operations performed by the enterprise on accounts in banks and credit institutions. Compliance with the cash balance limit set by the servicing bank in the cash desks of the enterprise in accordance with the calculation for setting a cash balance limit for the enterprise and issuing permission to spend cash from the proceeds received by its cash desk. Analysis of the financial and economic activities of the enterprise quarterly and in general for the year. Participation in determining the types of products (works, services) that are not in demand on the market, developing programs and measures to stop the production of such products. Participation in pricing certain types products (works, services). Participation in the determination of financial conditions in the concluded business contracts, examination of draft contracts submitted by counterparties. Analysis of accounting and statistical reporting. Formation of complete and reliable information about business processes and financial results of the enterprise, necessary for operational management and management Timely prevention of negative phenomena in the financial and economic activities of the enterprise, identification and mobilization of on-farm reserves. Development of measures to ensure the transparency of the financial condition of the enterprise (based on the improvement management accounting, transition to international standards accounting). Development of draft guidance materials on financing, accounting, reporting and other financial and economic aspects related to the competence of the department, and submitting them for consideration and approval to the relevant structural divisions of the enterprise. |

|

3.5 |

Development of accounting and tax policy |

Organization of work on the transfer of payments and contributions for taxes and fees to the federal budget, the budgets of Ukraine, the local budget, to state extra-budgetary social funds. Drawing up and submission to the tax authorities of the established documentation on the financial and economic activities of the enterprise. Maintaining daily performance records financial plan, including accounting: Volumes of products sold; Profits from sales; |

|

3.6 |

Development of credit policy of the enterprise. |

Interaction with credit institutions on the provision of credit resources. Preparation and submission of loan applications and quarterly cash plans to banks and credit institutions. Organization of work on the conclusion of agreements on the provision of loans. Financial processing of received loans. Work on the timely repayment of loans and the return of received credit funds in a timely manner. Ensuring the implementation of credit plans, including the payment of interest on the loan. |

|

3.7 |

Cost management |

Development of a strategy for the withdrawal of the company's securities to stock market with the determination of the costs of using various stock instruments: Determining the type of securities (shares, bills, bonds); Selection of a primary securities dealer or portfolio investor and agreeing with him the terms of sale and trading platform for primary trading; Planning an accompanying advertising campaign; Work with securities (acquisition of shares, bonds, etc.), control over the portfolio of securities. Development guidelines on issues of financing operating expenses, capital investments, and other activities. |

|

3.8 |

Ensuring the timeliness of tax payments, settlements with creditors and suppliers. |

Keeping records of the movement of funds and reporting on the results of financial activities in accordance with the standards of financial accounting and reporting. Control over the correctness of the preparation and execution of reporting documentation. Ensuring the reliability of financial information. |

|

3.9 |

Creation of conditions for the effective use of fixed assets, labor and financial resources of the enterprise |

Ensuring the timeliness and completeness of payments wages workers and employees of the enterprise. Development of measures for the sale, leasing and pledge of part of the assets, liquidation or conservation of individual capacities and facilities (including unprofitable, mobilization). Determining the amount of funding for research, development and design and survey work in accordance with estimates and contracts agreed with the structural divisions of the enterprise. Coordination of contracts for the performance of research and development work in terms of the reasonableness of the cost of work, as well as compliance with the terms of payment for work. Determination of directions and volumes of financing by the enterprise social programs(children's preschool institutions, educational institutions, charity events, etc.). Consideration of appeals and letters of citizens and legal entities on issues within the competence of the financial department, organization of inspections, preparation of relevant proposals. Participation in holding meetings-seminars with employees of economic, financial and accounting departments. |

- Regulatory documents

4.1. External Documents:

Legislative and normative acts.

4.2. Internal documents:

Charter of the enterprise, Regulations on the division, Job description, Rules of internal work schedule.

- Relationship between the finance department and other departments

To perform functions and exercise rights, the financial department interacts:

|

No. p / p |

Subdivision |

Receipt |

Providing |

|

5.1 |

with general accounting |

lists of creditors and debtors; Accounting information about the activities of the enterprise; Balance and operational summary reports on income and expenditure of funds, on the use of the budget; Reporting cost estimates for products (works, services); Plans for conducting inventories of fixed assets, inventory items and cash; Payroll calculations; |

Financial, credit and cash plans; Reports on repayment of loans, payment of interest on loans; |

|

5.2 |

With planning and economic department |

mid-term and long-term plans for the production activities of the enterprise; Copies of planned economic tasks of the enterprise divisions; Planned technical and economic standards for material and labor costs; Projects of wholesale and retail prices for the company's products, tariffs for works and services; Results economic analysis all types of activities of the enterprise; |

financial and credit plans; Reports on the implementation of financial plans; Financial analysis results; Methodical and instructive materials on the financial activities of the enterprise |

|

5.3 |

With Logistics Department |

projects of long-term and current plans for the logistics of the production activities of the enterprise; Reporting data on the movement of material and technical resources, on their balances at the end of the reporting period; Copies of claims filed by contractors; Draft claims against contractors in case of violation of their contractual obligations; Reports on the implementation of logistics plans; |

agreed draft claims; Proposals to eliminate the causes that served as the basis for filing claims and sanctions against the enterprise; Approved calculations of working capital standards |

|

5.4 |

with sales department |

draft contracts and agreements for the supply, sale of finished products; Forecasts and plans for the sale of products; Data on the state of stocks of finished products and their compliance with approved standards; Plans and schedules for the shipment of products; Data on the balance of products in warehouses; Proposals for taking measures to reduce excess balances of finished products and accelerate sales operations; |

financial plans; Information about invoices not paid by counterparties; Information of banks on letters of credit issued by buyers (customers); Notifications on the application of financial sanctions to buyers (customers) who violated their obligations to transfer funds for purchased goods; Approved calculations of working capital norms; |

|

5.5 |

With the marketing department |

Generalized data on the demand for products manufactured by the enterprise (work performed, services rendered); Marketing plans; Estimated costs for the formation of demand and sales promotion, conducting advertising campaigns, participation in exhibitions, fairs, exhibitions and sales; Information about competitive environment on issues of pricing policy, turnover volumes, competitiveness, speed of product sales; |

agreed cost estimates for demand generation and sales promotion with financial justifications; Analysis of costs incurred per month (quarter, year); |

|

5.6 |

with business department |

current and overhauls fixed assets of the enterprise (buildings, water supply systems, etc.); Estimated business expenses; Office equipment, forms of documents and stationery necessary for the work of the financial department; Material assets necessary for servicing meetings, conferences, seminars |

agreed estimates of business expenses; Calculations of payback of capital investments for implementation new technology, means of mechanization; Applications for necessary inventory and stationery; Reports on the use and safety of equipment and inventory; |

|

5.7 |

with legal department |

decisions on claims and suits filed by the enterprise; Generalized results of consideration of claims, court and arbitration cases; Explanations of the current legislation and the procedure for its application; Legal assistance in claim work; Agreed materials on the status of receivables and payables, proposals for the enforcement of debts; Analysis of changes and additions to financial, tax, civil legislation |

draft financial contracts for legal expertise; Materials for filing claims, lawsuits in courts; Conclusions on claims and lawsuits brought against the enterprise; Documents on the transfer of funds for the payment of the state duty to satisfy the claims and lawsuits brought against the enterprise; Applications for clarification of the current legislation |

- Rights

The financial department has the right:

6.1. Give instructions within the framework of control over the financial and economic activities of the enterprise on the preparation of financial documentation.

6.2. Require and receive from other structural divisions of the enterprise the data of the analysis of the economic activity of the enterprise, necessary for the activities of the department.

6.3. Conduct correspondence on the methodology of financial accounting and reporting, as well as other issues that are within the competence of the department and do not require agreement with the head of the enterprise.

6.4. Do not accept for execution and execution documents on transactions that are contrary to the law, violate contractual and financial discipline without a corresponding order from the director of the enterprise and the head of the legal department.

6.5. Represent in in due course on behalf of the enterprise on issues within the competence of the department in relations with tax, financial authorities, bodies of state non-budgetary funds, banks, credit institutions, other state and municipal organizations, as well as other enterprises, organizations, institutions.

6.6. Make proposals to the management of the enterprise on bringing the officials of the enterprise to material and disciplinary liability based on the results of inspections.

6.8. Conduct and participate in meetings on financial and economic activities of the enterprise.

6.9. In agreement with the director of the enterprise or the deputy director of the enterprise for commercial issues, involve experts and specialists in the field of financial consulting for consultations, preparation of conclusions, recommendations and proposals.

- Responsibility

7.1. The head of the financial department is responsible for the proper and timely performance of the functions of the department.

7.2. The head of the financial department is personally responsible for:

7.2.1. Non-compliance with the legislation of the instructions and guidelines issued by the department on the financial activities of the enterprise, financial accounting and reporting.

7.2.2. Preparation, approval and submission of unreliable consolidated financial statements and violation of the deadlines for its submission to the relevant divisions of the enterprise, the head of the enterprise, tax, financial and other authorities.

7.2.3. Failure to provide or improperly provide the management of the enterprise with information on financial matters.

7.2.4. Untimely, as well as poor-quality execution of documents and instructions of the enterprise management.

7.2.5. Assumptions for the use of information by employees of the department for non-official purposes.

7.2.6. Non-compliance with the labor schedule by the employees of the department.

7.3. The responsibility of employees of the financial department is established by their job descriptions.

- Final provisions

8.1. If any point of the situation is found to be inconsistent with the actual state of affairs in the financial department, the head of the department, employee or other person must contact

with an application for amendments and additions to the regulation. (The application form is presented in Appendix 1).

8.2. The submitted proposal is considered by the division specified in clause 8.1. this provision within one month from the date of application.

Based on the results of the review, a decision is made:

Accept the change or addition,

Send for revision (indicating the deadline for revision and the contractor),

Refuse to accept the proposed proposal (in this case, the applicant is sent a reasoned refusal in writing).

8.3. Amendments and additions to the regulation are approved

on submission

|

Head of structural unit |

|||

|

(signature) |

(surname, initials) |

||

AGREED: |

|||

|

Head of the legal department |

|||

|

(signature) |

(surname, initials) |

||

|

00.00.2000 |

|||

|

Familiarized with the instructions: |

|||

|

(signature) |

(surname, initials) |

||

|

00.00.00 |

|||

Financial work in enterprises is organized and carried out by financial services. At large domestic enterprises, special financial departments or departments are created for this. At medium-sized enterprises, financial departments or financial groups can be created as part of other departments (accounting departments, departments, services for analysis and forecasting, labor and wages, pricing).

In small enterprises, financial work is assigned to the chief accountant.

Financial services are given the right to receive the necessary information from all other services of enterprises (these are balance sheets, reports, plans, summary cost calculations, etc.)

The head of the financial department (department), as a rule, reports to the head of the enterprise or his deputy for economics and, together with them, is responsible for the financial condition of the enterprise, the safety of its own working capital, for the implementation of the implementation plan, and the provision of funds for financing the costs provided for by the plans.

The main tasks of the financial service are:

1. providing cash for current costs and investments;

2. fulfillment of obligations to the budget, banks, other business entities and employed workers.

The financial service of the enterprise determines the ways and methods of financing costs. They can be self-financing, attracting bank and commercial (commodity) loans, raising equity capital, obtaining budgetary funds, leasing.

For the timely fulfillment of monetary obligations, financial services create operational cash funds, form reserves, use financial instruments to attract cash into the turnover of the enterprise.

The tasks of the financial service are also:

1. promoting the most efficient use of fixed production assets, investments, inventory items;

2. implementation of measures to accelerate the turnover of working capital, ensuring their safety, bringing the size of own working capital to the economy of reasonable standards;

3. control over the correct organization of financial relations.

The functions of the financial service are determined by the very content of financial work in enterprises. This:

1. planning;

2. financing;

3. investment;

4. organization of settlements with suppliers and contractors, customers and buyers;

5. organization of material incentives, development of bonus systems;

6. fulfillment of obligations to the budget, optimization of taxation;

7. insurance.

The functions of the financial department (service) and accounting are closely intertwined and may coincide. However, there are significant differences between them. Accounting records and reflects the facts that have already happened, and the financial service analyzes information, is engaged in planning and forecasting financial activities, provides the management of the enterprise with conclusions, justifications, calculations for making management decisions, develops and implements financial policy.

The following functions are assigned to the financial department:

Development of the financial strategy of the organization.

Development of projects of long-term and current financial plans, forecast balances and cash budgets.

Preparation of draft plans for the sale of products (works, services), capital investments, research and development, planning the cost of production and profitability of production - participates in the preparation.

Calculation of profit and income tax.

Determination of sources of financing for the production and economic activities of the organization, attraction of borrowed funds and use of own funds, research and analysis of financial markets, assessment of possible financial risk in relation to each source of funds and development of proposals for its reduction.

Implementation of the investment policy and management of the organization's assets, determination of their optimal structure, preparation of proposals for the replacement, liquidation of assets, analysis and evaluation of the effectiveness of financial investments.

Development of working capital standards and measures to accelerate their turnover.

Ensuring the timely receipt of income, registration of financial settlement and banking transactions in a timely manner, payment of invoices of suppliers and contractors, repayment of loans, payment of interest, wages to workers and employees, transfer of taxes and fees to the republican and local budgets, to state extra-budgetary social funds, payments to banking institutions.

Analysis of the financial and economic activities of the organization.

Control over the implementation of the financial plan, product sales plan, profit plan and other financial indicators, over the termination of production of products that do not have a market, the correct spending of funds and the targeted use of own and borrowed working capital.

Keeping records of the movement of funds and reporting on the results of financial activities in accordance with the standards of financial accounting and reporting, the reliability of financial information, control over the correctness of the preparation and execution of reporting documentation, the timeliness of its provision to external and internal users.

Fundamental differences between financial service and accounting lies not only in approaches to the definition of funds, but also in the sphere of decision-making. Accounting is working on collecting and presenting data. The financial department (management), getting acquainted with the accounting data and analyzing all these materials, makes specific decisions regarding the activities of the enterprise.

I. General provisions

1. The head of the financial department belongs to the category of managers.

2. A person who has a higher professional (economic or engineering-economic) education and at least 5 years of professional experience in the field of organizing financial activities is appointed to the position of the head of the financial department.

3. Appointment to the position of head of the financial department and dismissal from

4. The head of the financial department must know:

4.1. Legislative and regulations regulating production and economic activities.

4.2. Regulatory and teaching materials relating to the financial activities of the enterprise.

4.3. Prospects for the development of the enterprise.

4.4. Status and prospects for the development of financial markets and sales markets for products (works, services).

4.5. Fundamentals of production technology.

4.6. Organization of financial work at the enterprise.

4.7. The procedure for drawing up financial plans, forecast balances and budgets of cash, plans for the sale of products (works, services), profit plans.

4.8. system financial methods and levers that ensure the management of financial flows.

4.9. The procedure for financing from the state budget, short-term and long-term lending to an enterprise, attracting investments and borrowed funds, using own funds, issuing and acquiring securities, accruing payments to the state budget and state extra-budgetary social funds.

4.10. The procedure for the distribution of financial resources, determining the effectiveness of financial investments.

4.11. Rationing of working capital.

4.12. Procedure and forms of financial settlements.

4.13. Tax law.

4.14. Financial Accounting and Reporting Standards.

4.15. Economics, organization of production, labor and management.

4.16. Accounting.

4.17. Means of computer technology, telecommunications and communications.

4.18. Fundamentals of labor legislation.

4.19. Advanced domestic and Foreign experience improvement of the financial activity of the enterprise.

4.20. Rules and norms of labor protection.

7. The head of the financial department manages the employees of the department.

8. During the absence of the head of the financial department (business trip, vacation, illness, etc.), his duties are performed by a deputy (in the absence of such, a person appointed in the prescribed manner), who acquires the appropriate rights and is responsible for due execution the duties assigned to him.

II. Job Responsibilities

Head of Financial Department:

1. Organizes the management of the movement of financial resources of the enterprise and the regulation of financial relations that arise between business entities in the market, in order to most effectively use all types of resources in the process of production and sale of products (works, services) and maximize profits.

2. Ensures the development of the financial strategy of the enterprise and its financial stability.

3. Leads the development of draft long-term and current financial plans, forecast balance sheets and cash budgets.

4. Ensures that the approved financial indicators are communicated to the departments of the enterprise.

5. Participates in the preparation of draft plans for the sale of products (works, services), capital investments, research and development, planning the cost of production and profitability of production, leads the work on calculating profits and income tax.

6. Determines the sources of financing for the production and economic activities of the enterprise, including budget financing, short-term and long-term lending, the issue and purchase of securities, leasing financing, raising debt and using own funds, conducts research and analysis of financial markets, assesses possible financial risk in relation to to each source of funds and develops proposals for its reduction.

7. Carries out the investment policy and asset management of the enterprise, determines their optimal structure, prepares proposals for the replacement, liquidation of assets, monitors the portfolio of securities.

8. Conducts analysis and evaluation of the effectiveness of financial investments.

9. Organizes the development of working capital standards and measures to accelerate their turnover.

10. Provides:

10.1. Timely receipt of income, registration of financial settlement and banking operations in a timely manner.

10.2. Payment of invoices of suppliers and contractors.

10.3. Repayment of loans.

10.4. Payment of interest, wages to workers and employees.

10.5. Transfer of taxes and fees to the federal, regional and local budgets, to state extra-budgetary social funds, payments to banking institutions.

11. Analyzes the financial and economic activities of the enterprise.

12. Participates in the development of proposals aimed at ensuring solvency, preventing the formation and liquidation of unused inventory items, increasing production profitability, increasing profits, reducing production and sales costs, strengthening financial discipline.

13. Monitors:

13.1. Implementation of the financial plan and budget, product sales plan, profit plan and other financial indicators.

13.2. Termination of production of products that do not have a market.

13.3. Proper spending of money.

13.4. Targeted use of own and borrowed working capital.

14. Provides accounting for the movement of funds and reporting on the results of financial activities in accordance with the standards of financial accounting and reporting, the reliability of financial information.

15. Controls the correctness of the preparation and execution of reporting documentation, the timeliness of its provision to external and internal users.

16. Participates in holding conferences-seminars (studies) with employees of the main accounting department and the financial department of the enterprise.

17. Participates in the development of proposals for the social protection of employees of the enterprise.

18. Ensures the protection of information resources containing their own information of limited access and received from other organizations.

III. Rights

The head of the financial department has the right to:

1. Act on behalf of the department, represent the interests of the enterprise in relations with other structural divisions of the enterprise and other organizations on financial matters.

2. Install job responsibilities for his subordinates.

3. Submit proposals to improve the financial and economic activities of the enterprise for consideration by the management.

4. Submit for consideration by the director of the enterprise:

4.1. Representations on the appointment, transfer and dismissal of employees of the financial department.

4.2. Offers:

On the encouragement of distinguished employees;

Bringing to material and disciplinary responsibility violators of production and labor discipline.

6. Participate in the preparation of draft orders, instructions, instructions, as well as estimates, contracts and other documents related to the activities of the financial department.

7. Interact with the heads of all structural divisions on the financial and economic activities of the enterprise.

8. Give instructions to the heads of structural divisions of the enterprise on issues of proper organization and conduct of financial work.

9. Sign financial documents under the authority of the director of the organization.

10. Approval of all documents related to the financial and economic activities of the enterprise (plans, reports, etc.).

11. Independently conduct correspondence with structural subdivisions of the enterprise, as well as other organizations on issues within the competence of the department and not requiring the decision of the director of the enterprise.

12. Make proposals to the director of the enterprise on bringing officials to material and disciplinary responsibility based on the results of inspections.