In this video review, we will analyze the capabilities of the 1C Management of our company (1C UNF) system for accounting retail sales.

It is worth noting that the 1C Management of our company system (1C UNF) is not intended for processing streaming sales - such as those used in large hypermarkets. 1C UNF is suitable for accounting for small sales, in some retail, not very large stores.

Before looking at the sales itself, let's see what settings need to be done in the preparatory phase.

Let's go to the section "Settings" => "Enterprise" and set the flag "Accounting by departments". In the directory "Structural units" we will create a "Department of various sales"

Here, in the "Enterprise" section, you can set the flag "Accounting by lines of activity" and in the directory "Lines of activity" enter an additional direction "Retail", if you need such analytics in the future.

Let's make sure that in our program 1C Management of our company (1C UNF) the prices for products we need for retail are registered.

Go to the section "Sales" => "Types of prices". I have separate view prices. It's called "Retail Price". If you do not use a separate price type, you can trade at any price, for example "Wholesale price". This price will be used for retail sales.

We need to create our outlets.

To do this, go to the "Settings" => "Purchases" section. Set the flag "Keep records of several warehouses (two or more)". We open the directory "Structural units". We create outlet"Shop 1 (ATT)". It will be used as an automated outlet. Retail type. It is necessary to specify "Retail type of prices".

We will also create another outlet “Shop 2 (NTT). It will be used as a manual outlet. We also indicate the retail type of price and the type "Retail".

Retail prices must be pre-calculated.

In the "Sales" section, on the "Price list" command, select the retail price. It is possible to set additional selections by price group and nomenclature. On the “Update” command, make sure that our prices are registered in the system.

If you use shop equipment, such as barcode scanners for goods, you need to generate barcodes at the preparatory stage. To do this, go to the nomenclature card. By hyperlink "More ..." => "Nomenclature barcodes" go to the barcode journal. Here you can set barcodes for the current stock item and each of its characteristics.

Consider the order of connection commercial equipment to the 1C Management of our company system (1C UNF).

Go to the "Settings" => "Connected equipment" section. It is necessary to set the flag "Use connected equipment". After that, you can follow the hyperlink directly to the "Connected equipment" setting.

For clarity, let's connect a fiscal registrar with the hardware driver "1C: Fiscal registrar (emulator)" to our 1C Management of our company (1C UNF) system. After we create such an entry, using the “Configure ...” => “Functions” => “Install Driver” command, you must install the driver and check the “Device Test”. The system reports that the test has been successfully passed. Additionally, you can specify other details that will be displayed on the printed cash receipt.

Let's write down and close this setting.

In the "Settings" => "Connected equipment" section, you also need to configure workplace cashier. The only thing to note is that such a workplace must be configured directly on the computer where it will be used and on behalf of the user who will work at this workplace.

My workplace was created by default. I will leave these settings and save.

Now go to the "Settings" => "Sales" section and here we already set the "Accounting for retail sales" flag.

Additionally, I set the flags "Archive KKM checks", "Delete unbroken KKM checks" and "Control balances when breaking KKM checks". If you do not need these settings, you can not install them.

Let's create a few we need at further work directory elements.

Let's start with the guide "Acquiring terminals". If you use connected acquiring terminals, then the drivers for these terms are configured in the “Settings” => “Connected equipment. Let's create 2 records of acquiring terminals for Store 1 (ATT) and Store 2 (NTT)

Let's create cash registers

In the "Settings" => "Sales" => "Cash registers" section, we will create a Cash Desk with the "Fiscal registrar" type. Outlet "Shop 1 (ATT)". Department of Retail Sales. Equipment "1C: Fiscal registrar (emulator)" on Alexander Semenov (Computer). If the equipment is used without connection to the workplace, then it is necessary to set the corresponding flag “Without connecting equipment.

Similarly, we will create Another cash register of cash register with the type "Autonomous cash register". Outlet "Shop 2 (NTT)". Department of Retail Sales.

The difference between KKM cash registers with the “Autonomous” and “Fiscal registrar” types is that if we use a fiscal registrar, then it is assumed that we reflect every sale, every punched check in the system. After closing the cash register, a report on retail sales is issued. If we use an autonomous cash register in the system, then each check is not reflected in the accounting. After a certain period of time, for example, once a month, once a week, an inventory is made at a point of sale in a store. Based on the results of the inventory, the quantity of goods sold is revealed. Based on these data, based on the results of the inventory, a retail sales report is generated.

We have made all the necessary settings.

Now we need to move the inventory items that are in the "Main Warehouse" to our outlets.

In the “Purchases” => “Movement of stocks” section, we create two documents in which we move goods for sale from the Main Warehouse to Store 1 (ATT) and Store 2 (NTT). It is possible to immediately receive goods from the supplier to a specific outlet.

If you look at the report “Remains of goods by warehouses”, we will see that our stores now have goods for sale on the remnants.

We proceed directly to the reflection of retail sales operations in 1C Management of our company (1C UNF).

Let's start with the fact that we will issue funds from the cash desk of the company to the cash desks of KKM. For example, change money. In the section "Money" => "Documents on the cash desk" we will create an "Expense from the cash desk". In the document, the appropriate type of operation "Moving to the cash register of cash register" is selected. It is indicated to which "Cashier KKM" we will move the money and the amount of money.

In the "Sales" section there is a separate report "Money in cash desks of KKM". If we form this father for today, we will see that at the box office of KKM we have already reflected the arrival Money. With the help of this report, you can control the state of money directly at the KKM Cash Desks.

In the "Money" section, you can also see what cash flows have been for today. Let's generate a report "Movement of money" and see that from the "Cashier in accounting" we had an expense of funds.

We are starting to reflect retail sales at an automated outlet (ATT) in 1C Management of our company (1C UNF)

In the "Sales" section, open the "Workplace of a cashier (RCC)". Let's go to the "My checkout" button. We will see our parameters that were set when opening the workplace: Organization, Retail outlet, Subdivision, Responsible, Price type, Cash register, Acquiring terminal.

By clicking the "Quick Products" button, you can go to setting up quick products. By clicking the "Settings" button, we select the products that will be displayed in this window, set a keyboard shortcut for them, and we can set the title. We write down this information. Now the goods are placed in our panel and we can quickly add them to the receipt.

By clicking the "Journal" button, we see the actual journal of KKM Checks, which contains our current checks for the current shift. It is possible to set the selection for the last shift or for an arbitrary period.

By the command “More” => “Deposit money”, we reflect the operation of depositing money into the KKM cash desk. The system punches a check on the fiscal registrar and then, for clarity, punched checks will be present on the screen.

Let's reflect the first sale. To do this, we select the goods in the check. You can do this with the "Select" command. A product selection window opens, where we can find the product we need by name. For the selected product, it is indicated in which store it is in stock.

If you are using a barcode scanner, you can search by barcode or enter it manually. If a data collection terminal is used, data can be downloaded from it. If goods by weight are sold and electronic scales are connected to the checkout, then after you pick up the weight goods in the check, you can get the weight from these scales by clicking the "Get weight" button.

Use the Plus and Minus buttons to increase or decrease the quantity of the selected product. Using the calculator, you can enter the quantity from the keyboard.

By clicking the "insert" or "Plus sign" button, you can add a new empty item line and enter data manually.

You can also add a new element by copying.

When all the information about the purchased goods is selected, the check can be accepted for payment. The 1C System Management of our company (1C UNF) asks how much cash and non-cash payment we have accepted.

IN this case we indicate that the buyer gave us 160 rubles. The system to calculate the change to be given to the buyer. If you need to print a sales receipt for the buyer, check the corresponding box and press the button to punch the check.

The program on the fiscal emulator breaks the check, which shows what product was purchased from us, at what price, what payment was received at the cash desk.

We will arrange another sale and accept payment by bank transfer by card. After the command "Accept payment" go to the tab " Cashless payment". We indicate the amount to be deducted from the card, indicate the type of card and its number. You can accept payments with multiple cards. Then we first indicate one amount, and then by the button "Add a card" we indicate the parameters of the second card and break through such a check.

If the buyer returns the goods and this product was purchased in the current cash register shift, such a return can be issued on the basis of those checks that were punched in the current shift. To do this, we go to the "Return" tab. We find the check on which the sale was made. On the basis of this receipt, using the command “Create KKM receipt for return”, we create a receipt for the return of goods. The system automatically fills in all the necessary information in it.

From the "KKM check for a return" you can print the "Act on the return of money to customers" in the form of KM-3, sales receipt. When all the information is filled in, you can break through such a check.

If the return of goods occurs for sales that were in the last shift, which is already closed, then two options are possible here:

- The buyer presented a cash receipt. We can make a selection of checks for the last cash register shift or for an arbitrary period. We indicate all the data that we need. We select the desired check and, on its basis, two documents will be generated. By the button "1. Create an incoming invoice for the return" of the goods and click the button "2. Create RKO on the basis of the parish.

- If the buyer is unable to present the check, the corresponding flag "Check not presented" is set. There is no selection of punched checks. We immediately create an incoming invoice for the return and an outgoing cash order for issuing money to the buyer without specifying checks.

Reflect the withdrawal of money from the cash register. To do this, click on the "More" button and select the "Money withdrawal" command. System 1C Management of our company (1C UNF) breaks through the corresponding check.

Now you can print the report without blanking or close the current shift.

When closing a checkout shift, the system automatically creates a Retail Sales Report document. On the Goods and Services tab, item items that were sold are indicated. The "Payment by cards" tab contains data on transactions that were carried out with plastic cards. This document can be posted and closed.

Let's look at the report "Money in cash desks of KKM". So far, our entire amount is still in the cash register. Therefore, we go to the “Money” => “Documents on the cash desk” section and reflect the receipt of funds in our main “Cash desk in accounting” from the “KKM cash desk” “Fiscal registrar”. Select the type of operation "Retail revenue" and indicate the amount of withdrawal of money. We are doing this operation. Now we have changed the balances on this checkout. Cash from the KKM cash desk moved to the main cash desk of the organization.

Let us now consider how retail sales are carried out in a non-automated outlet in the 1C system Management of our company (1C UNF)

We have transferred cash to this cashier for delivery to customers. This information can be seen in cash reports.

In a non-automated outlet, each sale, each punched check is not reflected using the KKM Check documents. The "retail sales report" is generated either in manual mode, or in automatic mode it can be generated on the basis of the document "Inventory of stocks". Such a document is located in the "Purchase" section.

We will conduct an inventory of stocks in a non-automated outlet.

Let's create the document "Inventory of stocks". Specify the warehouse "Store 2 (NTT)". By the “Fill” command, we indicate the option to fill in the tabular part “Fill according to the balances in the warehouse”. tabular part fill in automatically. It can then be adjusted manually.

In the "Quantity" column, we indicate the actual quantity of goods identified during the recalculation. Deviations of the actual quantity of goods from the accounting quantity are automatically calculated. Based on these data, after the inventory, we create the document "Report on retail sales".

The 1C Management system of our company (1C UNF) automatically filled in the quantity of goods sold with deviations from the inventory. Refill prices by retail type. On the "Payment by cards" tab, if we accepted payment by bank cards, we indicate this information from slip checks.

A fully completed document can be posted and closed.

In the report "Money in cash registers" we now see that we have increased the amount of cash in the Autonomous Cash Register. Also, with the help of cash desk documents, you can transfer funds from the Autonomous KKM to the cash desk of our organization.

We have covered almost all retail operations. Now let's see what information and in what reports we can get about our retail sales.

In the "Sales" section in the "Reports" group there is a "Commodity report TORG-29", in which we can specify the period, organization and outlet. The report is formed according to the standard approved form.

Another report that is also frequently used is the Warehouse Valuation. It is located in the Purchasing section. The report indicates the "Price type" by which it is necessary to evaluate the inventory balance. You can set the selection by store and/or item. By clicking the "Generate" button, we receive information about the quantity of goods in the warehouse, its cost, price, and an estimate of the quantity of goods based on the specified price.

We have considered almost all retail operations as they are reflected in 1C Management of our company (1C UNF). It remains only to deal with our acquirer.

In the "Money" => "All money reports" section, we have two reports: "Payment by payment cards" and "Acquiring settlements (summary)".

The report "Payment by payment cards" contains information about acquiring terminals, types of payment cards and accepted payment transactions. Of the numerical indicators, we have access to the Amount of the operation, the amount of the commission,% of the Commission (under the contract), the ratio Amount / Commission (%).

The Acquirer Settlements (Summary) report contains information about acquirers, acquiring terminals, as well as data on mutual settlements with the acquirer, payments made through acquiring terminals and due commission for such operations.

With the help of the document “Receipt to the account” from the section “Money” => “Documents for the bank”, the fact of crediting to the settlement account of payment by bank cards is reflected. The type of operation is selected "Receipt of payment by cards". The “Acquiring Bank”, “Acquiring Terminal”, “Amount” of crediting and the amount of the “Commission” withheld are indicated.

After posting such a document in the Acquirer Settlements report, we see that the entire amount has been received and the entire commission has been paid.

Thus, the 1C Management of our company (1C UNF) system reflects transactions related to the sale of goods at retail with payment both in cash and using payment bank cards.

Configuration: 1C: UNF

Configuration version: 1.6.6

Publication date: 10.03.2017

Without any doubt, the RMK mode (Cashier's Workplace) is very convenient for retail sales, over time, as it appeared in different versions of 1C programs, we see the evolution of the Front Office, in some 1C RMK programs it is a full-fledged sales mechanism, and in some then a nice addition, we will not consider positive and negative sides each of them, but we will only tell you how to quickly launch the RMK in 1C: UNF 1.6.

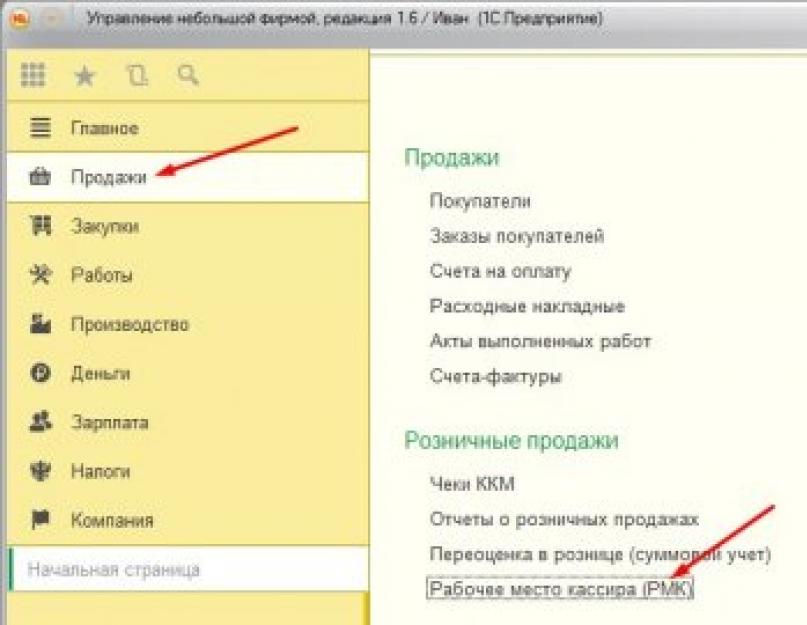

First, we will look at where the RMK itself is hiding and how it will be configured. We go to the section Sales - Workplace of the Cashier (RMC).

To work, we need to set up the KKM Cash Desk and the Acquiring Terminal. Unlike other programs, it requires relatively little to fill out, allowing you to do it yourself and quickly get Retail Sales up and running.

Do not rush and start with the KKM Cashier. If you are working with KKM connected equipment, then you need to set the settings for the connected equipment. Go to Company - Administration.

Go to the section Connected equipment. This item stores all our devices working with 1C. 1C uses its own mechanism 1 WITH:Library pluggable equipment (BPO 8), this guarantees the same operation of the equipment and interface in all versions of 1C: 8.3 programs.

Enable the ability to work with Connected Equipment.

Adding a new device. We will add the emulator you have when using fiscal registrar there may be another device, and if you work without FR, you can use the Emulator.

If your device driver is not installed, install. And look at the settings of the Fiscal Registrar Emulator.

Now back to step 2. Filling in Cashier KKM! If you do not use the equipment, set the flag Without connection and forget about the Fiscal registrar.

We also set up the Acquiring Terminal. I am a supporter of full integration of equipment, but when working with integrated acquiring terminals, there are a lot of problems, especially if your acquirer is Sberbank, their specialists can set it up for 2 days and leave without finishing. We will work without connecting to the system, because setting up driver versions for it is like looking for a needle in a haystack. Pay attention to the meaning Checkout KKM and flag Without connection.

Setup completed. In the main window, you can set the flag Do not show this window again.

We open the RMK window in 1C: UNF 1.6. It looks very nice RMK, there are not a lot of buttons. Simple and tasteful.

We open the selection of goods. We see Hierarchical navigation, fields are immediately available Remaining stock And Price. At the bottom, we can manually enter the Product Price, Quantity and Discount. This is something new, a discount when choosing a product. And the meaning lies in the provision of discounts line by line!

After transfer press the button Accept payment (Ctrl+Enter), the calculation window opens. And here we see innovations again! Namely, the form immediately assumes 2 types of calculation, in other versions of the program we saw 3 types, Cash, Bank transfer and Complex, here, in fact, Complex payment always opens, but we can carry out the 1st type of payment without breaking the amount.

Summarizing, RMK setup in 1C: Management small firm 1.6 has evolved and is already fully operational, now you can carry out both Retail and Wholesale in one program. Many will argue offering Trade Management as an alternative to UNF, but this is a moot point, because UT 11.3 is very inconvenient in administering retail sales, demanding hardware and the most difficult setup (among 1C programs). I think time will tell, about 5 years ago 1C: Retail was also underestimated, and now it is already occupying its niche as a Front Office in stores.

Software"1C: Management of our company" is presented on the market as a multifunctional managerial decision for small business. Initially, it was called "1C: Management of a small company", but it was renamed at the initiative of the partners of the 1C company.

1C UNF meets the two main requirements of small businesses - low cost and minimal implementation costs. Suitable for enterprises with a small number of employees (10 - 20 people). But it should be noted that there are no strict limits, and everything is determined by the needs of the company. It can be used in such areas of small business as:

- wholesale and retail;

- Performance of work and provision of services;

- small production;

- Internet trade.

When you start working with the 1C UNF program, the initial setup assistant is automatically called up, at the prompts of which you can configure everything you need to work or, if necessary, use the services of a specialist who will install the program. As a rule, 1C partners in the purchase of programs include one hour or more for free setup.

Consider the capabilities of 1C UNF on the example of the demo base edition 1.6 (version 1.6.10.40)

The bootloader window might look like the one in Fig. 1 (approx.). All functions are grouped into sections with clear and simple names, so there will be no difficulty in navigation (Fig. 1, left side). The proposed set of forms in configuration 1.6 allows you to customize the initial page to suit your needs (Fig. 1, right side). To do this, in the main menu, you need to go to the item “View - Customize the initial page” and select the necessary indicators in the window that opens.

Rice. 1

The program has a wide range functionality:

- Small production (piecework, custom);

- Trading operations and service accounting;

- Retail and Internet sales;

- Pricing;

- Warehouse accounting and purchases;

- CRM (interaction with buyers);

- Accounting and financial management;

- Salary and staff;

- Submission of regulated reporting for individual entrepreneurs (USN, UTII);

- Analytical reports;

- Data exchange and integration.

We give a brief description of the sections 1C UNF 1.6

Some functions are repeated in different sections, but the composition can be configured in any form convenient for work by making the necessary changes in the program configuration.

CRM

Orders and invoices are managed, order fulfillment analysis, sales planning and analysis, price lists formation, events and tasks planning and notification, mass mailings letters and SMS, risk assessment by counterparties, analytical reports, segmentation of counterparties (dividing into categories according to various criteria), control of mutual settlements.

There is a mechanism for notifying changes in the status of orders. The buyer can be sent an SMS notification or an email, a reminder to the manager, a task, a calendar entry.

Section "CRM - Rules of the workflow" (Fig. 2).

Fig.2

Sales

Wholesale - customer orders, product sales, product reservation, task to work with orders, product management, price management, price lists, sales planning by various parameters: managers, departments, groups and product categories.

Retail - KKM checks, cashier's workplace, revaluation, exchange with equipment (cash desks) operating in offline mode. There are various reports for sales analysis (Fig. 3).

Fig.3

Orders to suppliers, invoices from suppliers, registration of goods receipts, price lists of suppliers, inventory management, inventory management: control, movement, reservation, analytical reports and reconciliations with suppliers, procurement planning - automated calculation of the procurement plan for goods and inventory requirements ( Fig.4).

Fig.4

Planning and control of work performed on work orders, work assignments, accounting of working time, work schedules. There is a visualization of the stages of implementation and the state of payment, an analysis of the degree of implementation (Fig. 5).

Fig.5

Production

Orders and placement in production, planning and control of the execution of production on orders, the formation of piecework orders based on customer orders, accounting and distribution of costs, inventory management, time tracking, production reports.

Money

Accounting for cash and non-cash funds, financial flow planning, money reservation, payment calendar, card acquiring operations (Fig. 6).

Fig.6

Salary

Personnel records, payroll documents, payroll guides, timesheets, payroll reports: payroll, payslips, etc.

Company

The section contains all directories, data on property, planning of budgets and sales, setting up and administering the program, entering initial balances, financial operations, the possibility of electronic document management, integration with other programs, analytical reporting of the company.

From the large number of functionalities of 1C UNF 1.6, we highlight the most useful:

- A common block of settings for all sections of the program with interactive prompts for choosing options. Opens in any section under the item "Even more opportunities";

- Doing management accounting for several organizations, and with a given setting - for the company as a whole;

- Pricing is based on base prices. There is a percentage markup calculation, fixed amount, arbitrary formula (formula builder is used);

- Monitor current state companies on the home page is configured individually to receive the most necessary and up-to-date information about the company, reminders of business and other events. A short management balance sheet allows you to control the state of the company for any period (Fig. 7).

Fig.7

- Simple and informative management of orders to suppliers, from buyers and to production, as well as work orders. (Fig. 8).

Fig.8

- Planning and adjusting work schedules can be done directly from the order-work order, production order, piecework order, work assignment documents (Fig. 9).

Fig.9

- In the scheduler, there is a schedule for the status of the execution of production orders. It can also analyze the planning and use of labor resources.

- Planning for the receipt and expenditure of money is carried out by the relevant money planning documents. It is also possible to do this directly from incoming, outgoing invoices and work orders. In the payment calendar, you can create a plan for the desired period.

- In 1C UNF 1.6, only management accounting can be kept. To maintain regulated accounting (except special regimes) you need to use "1C: Accounting". Integration can be configured through the built-in data exchange mechanism. Integration with other 1C programs is also possible.

- Submission of regulated reporting is possible, but only for individual entrepreneurs using the simplified taxation system (ONS) or the system for the payment of a single tax on imputed income (UTII).

- Can be exercised electronic document management with a bank client. Also with counterparties in the presence of the connected service "1C-EDO" or "1C-Taxcom".

- It is possible to interact with the organization's website. In particular, you can import orders from the site and update product data on the site.

In 1C UNF 1.6, it is possible to use other 1C services, including the newest ones - 1C Counterparty, 1SPARK Risks, 1C Reporting, 1C DirectBank, etc.

You can implement the program in stages and choose the cost. For example, in the basic version, the cost of UNF 1.6 is minimal, but there are limitations - you can work in one infobase and only one user at a time, and keep records for no more than two organizations. In addition, you cannot modify the configuration (update only).

In the professional and package versions of the program, there are significantly more opportunities. This is a multi-user mode, an unlimited number of organizations, work through the web interface, as well as with external connections, support client-server mode. At the same time, additional licenses can be purchased as the number of users increases.

In conclusion, we can say that 1C UNF 1.6 is a product specially designed for small businesses. Possesses a wide range of possibilities flexible settings, simple and intuitive interface. Allows you to introduce functionality gradually, as new requirements arise. At the same time, 1C UNF is not complicated and practically does not require special knowledge of accounting.

We plan to update the application " 1C: Small business management 8» in service website to the new version 1.6.8.

We will perform the transition gradually - first we transfer some of the users, then the remaining users.

New features in UNF 1.6.8

Below is list of new features in version 1.6.8.

A detailed description of the new features of version 1.6.8 with examples and pictures is given on the page http://its.1c.ru/updinfo/smallbusiness/1.6.8 .

Transition to online cash registers with data transfer to the Federal Tax Service (54-FZ)

In accordance with new edition federal law 54-FZ dated 07/03/2016 No. 290-FZ from July 1, 2017, organizations and most individual entrepreneurs will have to use only new generation cash registers (online cash registers). From July 1, 2018, the use of online cash registers will also become mandatory for UTII payers and entrepreneurs on a patent.

The peculiarity of the new cash desks is that all information about payments will be transmitted through the fiscal data operator directly to tax office. In addition, in each check it will now be necessary to provide the composition of information specified by law, including the name of the product (service), price, VAT.

Current news feed: http://v8.1c.ru/kkt/news/

New service "1C-OFD"

1C cooperates with CRE manufacturers and fiscal data operators. 1C:Enterprise 8 programs implement functions for efficient and convenient operation with online checkouts.

In order to simplify the connection to fiscal data operators and interaction with them, 1C launched a new service 1C-OFD (https://portal.1c.ru/applications/56).

The new version of 1C: UNF has the ability to work with online cash registers with data transfer to the Federal Tax Service (54-FZ)

Added the ability to enter the subscriber number or e-mail address of the buyer in the form of the Cashier's Workplace and documents: KKM check, KKM check for a refund, Checkout, Checkout expense, Operation with payment cards. When the check is broken, its electronic version will be sent to the client.

The following objects have been added:

- Document "Cash shift". It contains cash register shift data received from cash registers at the time of shift opening and closing.

- Document " cash receipt corrections" designed to generate correction checks in accordance with the requirements for cash registers.

The format of fiscal documents is supported, version 1.0 of 05/05/2016.

POS equipment support

The work of cash equipment is implemented using "1C: Library of connected equipment" version 2.0.1.7. In this version of the BPO, a new type of equipment "CRE with data transmission" has been added, which supports work with cash register equipment with the function of data transfer to OFD in accordance with Federal Law No. 54 "On the use of cash registers".

The list of certified connected equipment has been expanded: http://v8.1c.ru/libraries/cel/certified.htm.

Drivers supported, developed in accordance with the document "Requirements for the development of drivers for connected equipment, version 2.0":

- Driver "Shtrih-M:KKT with data transfer to OFD (54-FZ)" version 4.13, developed by "Shtrikh-M".

- Driver "ATOL:KKT with data transfer to OFD (54-FZ)" version 8.12, developed by "ATOL".

Changed the composition of the supplied drivers

- Added driver "Spark:Fiscal registrars Prim" version 1.0.0.5, developed by SKB VT Iskra. Developed in accordance with the document "Requirements for the development of drivers for connected equipment, version 1.6".

- Added driver "ISBC: RFID Reader" version 1.1, developed by the company "LLC Intelligent Systems Business Management". Developed in accordance with the document "Requirements for the development of drivers for connected equipment, version 1.6".

- Added driver "Scancode: CipherLab RFID Readers" version 1.0 developed by Scancode. Developed in accordance with the document "Requirements for the development of drivers for connected equipment, version 1.6".

Updated driver "Scancode: Driver for label printer GodexEZPL8 (NativeAPI)", developed by Scancode, up to version 1.0.0.24:

- Added support for 64-bit client for Windows;

Updated drivers "1C: Barcode Scanner (NativeApi)" and "1C: Barcode Scanner (COM)" up to version 8.1.7.10:

- Added support for 64-bit client for Windows;

Updated driver "1C: Customer display (NativeApi)" up to version 1.0.5.1:

- Added support for 64-bit client for Windows;

Updated driver "1C: Receipt printer (NativeApi)" up to version 2.0.3.1:

Added the ability to print QR codes. Now, using the 1C Receipt Printer driver, you can print QR codes. The automatic code size is calculated based on the given width of the tape in characters. Optionally, you can set a custom code size. With a custom width value of "0", the automatic QR code size value will be used.

To successfully print a QR code, the user needs to carefully select the width of the tape or the size of the barcode, otherwise printing errors may occur.

- Added the ability to select the level of correction of the QR code. A corresponding field has been added to the settings page.

- Team support added batch printing PrintTextDocument / PrintTextDocument in accordance with the document "Requirements for the development of drivers for connected equipment, version 2.0". If the batch print fails to print the barcode, a message will be printed;

- Added support for 64-bit client for Windows;

- Withdrawn from support drivers "ORION: Fiscal registrars FR01K", "Version-T: Fiscal registrars", "Privatbank: Acquiring terminals Ingenico ECRCommX". Models with drivers are not supplied as part of the library, driver handlers are left to ensure the operability of acquiring systems previously installed at the workplace.

- Removed from configuration handlers of previously deprecated drivers "INPAS: AcquiringTerminals", "SoftCase: AcquiringTerminals", "SCALE: Scales with label printing CL5000J".

Updated driver "Scancode: Driver for TSD CipherLAB 8x00 (NativeApi)", developed by Scancode, up to version 1.0.0.6:

Support Center for Amendments to Federal Law 54-FZ

The Support Center was organized on issues of changes in Federal Law 54-FZ. Qualified specialists of the 1C company will advise you on the issue of connecting to the OFD, help with the registration of cash desks in personal account taxpayer to the Federal Tax Service and connecting cash desks to OFD.

The Support Center can be contacted through the following channels:

- through 1C-Connect, services "1C-OFD. User support”, “1C-OFD. Partner support";

- single free federal number 8-800-333-93-13 ;