The crisis seized the country for many years, so as not to go bankrupt on the payment of taxes, wages are tied to the minimum wage (minimum wage). But every year the minimum wage increases, which is why the question arises of how salary changes should be processed. For all the same reasons, the salary can be reduced.

Of course, employees will definitely not be happy about this, so the number of lawsuits and complaints increases significantly every year. In order to certainly do without problems, courts and inspectors, salary changes should be exactly according to the law.

Change the amount of salary for an employee, in positive or negative side can only be done at the request of the immediate supervisor. For example, a worker has achieved excellent results in his work. To motivate him for further growth and labor merits, the boss wants to raise his salary.

This is done by writing an order to change the salary of a worker. To do this, the official must accurately indicate the reason for the change in salary, or wishes for its increase. If the amount of payment is reduced, then the wishes of the superior person are not taken into account.

If the employer decides to raise the salary of his subordinate, he is obliged to do this by drawing up a memo. And it is possible to reduce the amount of payment only for serious reasons, which may be related to the reorganization of working conditions.

These can be various technical reforms, improvement, reconstruction of jobs based on their certification. The most important thing is that the position of the employee does not worsen in comparison with the terms of the collective agreement. In another case, when an employee goes to court, such a change in salary will be determined as illegal.

You can find out how to change the salary in the 1C Accounting program here:

When discussing a decrease or increase in the salary of an employee, one should not forget that the conditions of remuneration are the main condition that is spelled out in the employment contract and must be observed under the law on the Labor Code Russian Federation. When, the boss and subordinate must conclude an additional written consent.

The process of reducing wages should be discussed in more detail. All changes in salary must first be notified to the employee in writing, no later than 2 months before the possible change.

The employee must receive a written notice and sign. In the event that the employee does not wish to continue working under the new conditions, the employer is obliged to offer him another more suitable job in writing.

Perhaps it will vacancy, or a position that will correspond to the qualifications of the employee. Any new position should be suitable for the employee in all respects, taking into account his health. To do this, each employee is issued a document against signature, with a list of all vacancies suitable for him.

How to prepare a salary change order

The most common reasons for changing the salary of employees in the state:

- Combination of work positions;

- Sharp economic downturn;

- Service order of the head.

Usually, the main reason for creating a document is a memo from the head to the director of the enterprise. After the director accepts the order to reduce the salary, no later than 2 months, the employee is notified in writing, but if the salary increases, this stage is skipped.

The director's salary changes in the same way, the scheme is the same. Only instead of a memo - the protocol of the founders of the enterprise. After signing, an additional agreement is created to the director's contract. After that, there are already changes in the schedule, which are fixed by order of the head.

It is worth noting that wages are reduced quite rarely, since serious reasons are required for this, nevertheless, after a salary reduction, the position of an employee should not be lower than that of employees of the same category.

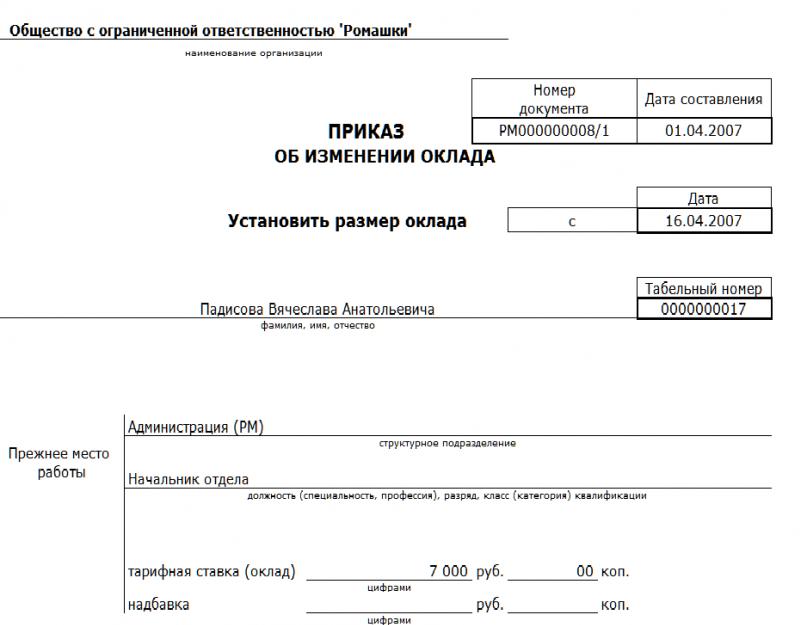

Sample letter to change the salary of an employee. Photo: infostart.ru

Sample letter to change the salary of an employee. Photo: infostart.ru How to format so as not to make a mistake

The personnel department should deal with all the documents, everything should be submitted on the letterhead of the organization in any form. The main thing is that the following details are present:

- Place of compilation;

- Name;

- Date and registration number;

- The position of certain workers;

- Date when the salary will be changed;

- The amount of the new salary and other payments;

- If necessary, the procedure for recalculation;

- Persons who are responsible for the execution of the order.

Form and signature

Further, the document must be signed by the head of the organization. Its copies are sent to the personnel department and accounting department, another copy is given to the employee. If you wish to further cooperate with the organization, the employee must read and sign the paper.

Since the order does not have an exact form, it is possible to draw it up in any arbitrary version, but it must necessarily contain all the important details. The text of the order must indicate the change, a reference to the standard contract should also be indicated, and the reason for the reform should also be indicated.

An example, due to changes in the staffing table, which involves the creation. At the end, there must be the signature of the director and employee. It is very important that the document has exactly two signatures, otherwise it is considered invalid.

How to write a document correctly?

How to write a document correctly? Staffing reforms

When the manager makes a new order, the issue of changes in the staffing table should immediately be resolved. If an order for a pay increase is accepted, it requires information such as:

- List of employees to whom the increase will be assigned;

- The amount of the new salary;

- Allowances. you can learn how to properly draw up a provision on employee bonuses;

- Date when new mode will become active.

The reason for the reform must be written in strict order, at the beginning of the document! Otherwise, if the act does not comply with the rule, then such a change will not be valid. All employees are required to read the order in writing and sign.

The staffing table is a local document in which adjustments can be made as needed. Their correct compilation is the confidence that the whole procedure will pass without any problems. Find out how to get an extract from the staffing table and where to go to get it.

If the boss makes a mistake when drawing up an order or in the process of familiarizing employees with it, completing additional documentation, the consequences will be very negative. For example, he will have to reinstate all illegally dismissed employees and pay them compensation.

Different salaries for the same positions

Almost all organizations have different salaries for employees of the same category. The reasons for this phenomenon may be as follows: the employee has a degree, extensive work experience in the specialty.

However, according to employment contract all salaries of employees of the same rank must be identical. Therefore, the whole process is controlled by allowances, for example, for knowledge of another language or degree for great experience.

How to increase salary in the 1C program - see this video:

It is not always possible for an employee to receive an increased salary. The employer may decide to reduce the monthly income. Will such a verdict be lawful and is a reduction allowed? wages how to issue unilaterally, more details in the article.

Salary reduction at the initiative of the employer

According to the Legislation and the Labor Code of the Russian Federation, the salary level should not be lower than the level of the minimum wage. However, the size of the salary under the contract should be a variable value. In case of an important reason for reducing income, the employer has the right to use it. According to the law, it is possible to draw up a reduction in monthly income only taking into account the terms of the employment contract. Based on the provisions of Article 72 of the Labor Code of the Russian Federation, it is possible to reduce the salary of labor only on the basis of the consistency of the two parties: the manager and the ward.

In connection with the reduction of wages, the employer must also take into account the provisions of the Federal Law "On the minimum level of working wages". If there are good reasons, the employer can issue a reduction in wages both for one employee and for a group of employees.

In what cases, according to the Labor Code of the Russian Federation, the employer has the right to reduce the salary of employees?

Although it is illegal to set a wage level that should not be less than the subsistence level, an employer, for good reasons, may implement a slight or significant reduction in wages. The list of situations in which a reduction in salary is legal includes:

- Mutual agreement.

- The desire of the worker.

- liquidation of the organization. In order not to fire employees at all, the manager may offer them a reduction in the salary level. However, this procedure is carried out only with the consent of the employee. Under the Law, the employer is prohibited from reducing the level of wages unilaterally.

- In connection with the reduction of production tasks on the part of the employee, the official can implement a reduction in wages without violating the terms of the contract and the Federal Law. In other words, the quality of the performance of a given volume by the ward affects the decrease in the level of wages.

- Financial problems of the enterprise. In this case, the employer may offer employees to reduce the amount of wages.

Before signing the legal documentation on the reduction of wages, the manager must indicate to the employees the reasons for such a decision and support them with evidence from the outside. Legislative framework RF.

How to apply for a reduction in the salary of an employee?

Before signing the relevant documents, the employer must notify employees of their reduction in income for two months. To do this, the boss draws up a notice that refers to a decrease in the level of wages and the basis on which such a conclusion is built. After the employee has considered the notification and agrees with the previous changes, the boss draws up an additional agreement. After it is signed by the workers, the employer issues an order. The order is drawn up taking into account the changes, grounds and number of employees who will be subject to a reduction in wages.

The final point in processing a decrease in income for employees will be a note in the staffing table about a change in income level. At the same time, the mark is placed taking into account the signature of each of the employees.

Salary change request sample

Before issuing an order, the boss must rely on the provisions that are spelled out in the Labor Code. For a properly drawn up order, you need to include:

- Full name of the organization.

- Contact details of the official and his position.

- The essence of the order: the reason for issuing the document and the basis on which such a change is valid is prescribed.

- Personal information of employees who have been affected by a reduction in their salary level.

- Signature and seal of the head.

Only after consideration of the order by the ward, the legal document will have legal force.

How long does it take for an employee to receive a pay cut?

According to the Law, the boss must notify the employee about the reduction in wages at least two months in advance. If the head is an individual, the notice must come to the ward within two weeks. Notice of a pay cut for a religious organization must be received no later than seven days. Such a right is regulated in accordance with Article 344 of the Labor Code of the Russian Federation.

There is no exact form for filling out the notification, so the manager must rely on the model that operates within the organization. The required information to be included in the notice is:

- Full name of the enterprise and its legal address.

- Information of the head, his details and position.

- The exact number of employees who fell under the reduction in income.

- Personal data of employees.

- The reason for reducing the level of salary and the basis for such action.

- Consequences that may affect the organization in case of not applying the salary reduction.

- Signature and seal of the head.

The document will become valid only after sending a copy of it to each worker. The final stage of the conclusion of the notification is the consideration and signing of it by the employee.

Dismissal of an employee at the initiative of the employer

According to the Labor Code, the manager does not have the opportunity to dismiss an employee without a reason. In the 81st article ...

Forms and systems of wages

To encourage for the work done and the time spent on it, enterprises regularly pay hired workers ...

Job description for payroll accountant

The calculation of salaries of employees, taking into account the deduction of all insurance premiums and other deductions / accruals, is a mandatory process ...

The procedure for paying wages

According to the Labor legislation in 2018, the deadline for payment of wages must be no later than the 15th. ...

Withholding from wages

If any executive document is received by the accounting department of the enterprise, then part of the income of the employee, to whose address ...

Writ of execution deduction from wages

There are several rules in the Labor Code on the basis of which a company or employer can make a withholding ...

The legislation of the Russian Federation provides for a change in the amount of wages by the employer. The corresponding procedure requires the execution of a special document and has legal subtleties.

Dear readers! The article talks about typical ways to solve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

In this article, you will get the following information:

- whether it is mandatory to draw up an order;

- when the salary can change;

- the basis for the appointment and who carries out such actions;

- unified form;

- how to compose, present samples;

- how to notify employees;

- what actions should be taken if an employee refuses to change salary.

Is it necessary

An order to change the salary of an employee is a mandatory document. Wages can either go up or down. The employer notifies employees of upcoming innovations in writing no earlier than two months before the change in wages ( individuals- 14 days, religious institutions - a week).

The manager draws up an agreement with the subordinate, signs it and attaches the paper to the employment contract. The issuance of the order completes the procedure for assigning a new salary, its approval and launches the process of implementing payments according to the updated settings.

The official introduces the employee to the document and sends it to the accounting department. In accordance with the content of the order sheet, a person is allocated cash now in a different size.

When does the salary change?

The salary may vary depending on the preferences of the owner of the enterprise, and on the needs of the organization, and on the pricing policy for the provision of services. This situation may depend on the economy of the country as a whole.

At present, wage cuts are rare, but we are talking about possible reasons. Business owners sometimes have to increase the prices of their products or the cost of providing services.

Let's imagine a table of examples of increase and decrease in salaries:

In another way, reducing the number of employees is called optimization. An employer can dismiss a certain number of employees, leaving the most qualified and conscientious specialists.

Such a situation arises in the case of, for example, the purchase of new equipment, which makes it possible to carry out labor activities with a minimum number or without the participation of people at all.

An increase in the number of employees may entail a negative change in salary due to expenses. In accordance with the tax legislation, the employer, in addition to salaries, is obliged to pay insurance premiums for each employee hired under the contract.

Let's stop on a way of economy of the enterprise. There is one legal trick that allows you to save a lot without reducing your salary. An employer may ask an employee to register himself as a sole proprietorship.

Then he will avoid paying a tax of 13%, as well as contributions to health and pension insurance. Payment for the services of entrepreneurs is not taxed, because the individual entrepreneur pays "for himself" on his own.

Sometimes employers (they are not required, just own initiative) themselves compensate for the expenses of hired "self-employed" citizens, if the latter choose the simplified tax system of 6% "income minus expenses". Compensation of tax and insurance costs for entrepreneurs turns out to be more profitable than similar payments for an individual!

Base

The answer to the corresponding question depends on the situation: the employer lowers or raises the salary of the employee.

In the latter case, the grounds are not required, it is enough to notify the employee and, on his own initiative, issue an order to the accounting department. Both line managers and senior management have the right to perform these actions.

With a decrease in wages, the situation is different, the grounds provided for by Article 74 of the Labor Code of Russia are necessary:

- organizational change;

- and technological conditions of work (updating equipment, production technology or its structural reorganization).

The notice must clearly disclose the reasons for such actions, familiarize the employee with it and invite him to put a personal signature. Without a signature certificate of the document by the employee whose salary will be reduced, issuing an order and lowering wages is illegal!

It is worth knowing that the employer “on his own initiative” does not have the right to lower wages. Allowed only in accordance with a serious reason, such as the purchase of automated equipment or huge losses for the enterprise, and this must be proven.

Another duty: the manager must offer the employee in the notification other vacant positions(if available, list those under which the employee falls within the scope of competence).

Without justification, all further procedures for lowering wages are prohibited. The employee has the right to apply to the Court in case of violations.

Who draws up

The order to change wages is issued by the head of the enterprise. An order for a reduction in salary can only be drawn up by a senior official in accordance with the grounds.

About increasing wages - bosses, including low-level ones. The compiler leaves a signature on it, after which he introduces the order to the officials to whom it is addressed. They sign it.

unified form

The order is made in free form. There is no unified version of the document, as reported by part 9 of the article 4 federal law number 402 "O accounting". Employers create forms of documents on their own.

How to write and its sample

Procedure order:

- At the top in the middle we write the full name of the enterprise.

- Below is the wording. "ORDER", its number, "On changing the salary."

- Below on the left we indicate the city, on the right - the date of publication.

- Essence, from the red line. “In connection with the circumstance (indicate which)”, below, in capital letters, the leader writes: “I ORDER:”.

- The following is a numbered list: “1. Assign to the employee (indicate to whom) a monthly salary in the amount of ". Enter the amount first as a number, and in brackets - in words. "2 to the chief accountant - to ensure payments in accordance with the changes made."

- Effective date: "Enter this order from the month of the year."

- Appointment of supervisory bodies: "I reserve the control of its implementation." It is also allowed to issue the corresponding obligation to other persons.

- Position of the publisher, signature and transcript.

- Below, "Agreed with", a list of recipients (who ordered). Their signature and transcript.

An example of an order to change salary:

Due to the increase in the minimum wage

If the order is issued for the appropriate reason, then it is indicated as follows: “In connection with the increase in the minimum wage, I ORDER:”, then similarly.

On the staffing table

In one order, the establishment of a new staffing table and an increase (decrease) in salary is prohibited. These are two different papers. Another document is published, where the manager similarly describes the essence (“make changes to staffing”, innovations are indicated).

Multiple employees

The order may indicate several persons responsible for its implementation. Each point of the essence corresponds to a specific addressee. At the end of the document, the relevant citizens are listed for murals.

Director General

The general director, if there is no one higher than his position in the enterprise, has the right to assign a different salary to himself. In such cases, he enters his full name (whom to appoint) in the order and issues it himself against signature.

How to notify an employee

In a free form, a notification sheet is created, which indicates the addressees (to whom, from whom) and the positions of both parties.

The essence of the order must contain the reason for the innovation. The notification is made in paper form (handwriting is allowed). The notifier puts the date and signature. The employee must read the application and sign it.

What to do if an employee refuses

There are frequent cases of refusals of employees to make changes in the size of their salary. If the employee refuses, then he should be offered a different position, which involves less labor costs. If possible, the subordinate receives a transfer offer.

When an employee from the listed alternatives is not satisfied with anything, the employer remains to offer dismissal on own will or to persuade him to work on new installations.

Employees should be attentive to changes in terms of wage reduction. Employers can write a memo for a non-existent reason.

If violations are found, try to record the information you receive and file a lawsuit with the Court.

From this article you will learn:

- How to submit a change official salary;

- Where can I find a sample salary change order?

- What does a salary change notification template look like?

- How is a salary agreement drafted?

Salary change: on what basis?

A change in the salary of an employee is usually accompanied by an increase in the amount of wages. This is possible at the discretion of the employer and only if he has financial capabilities. Salary increases may not be for all employees, but for, for example, the most successful and deserving. The basis for issuing an order to change the salary may be a memo drawn up by the immediate supervisor of the employee.

Example

The employee has achieved significant success in her work. In order to motivate the worker for new labor exploits, her supervisor decided to petition for an increase in her official salary. He wrote a memo (see sample below.

Sample memorandum for salary increase

Salary change order: what to write?

Salary change order: what to write?

After filling out a memo and agreeing with the authorities, it is necessary to achieve a change in the salary in the staffing table. To do this, an order is issued to change the salary. It may contain the following wording:

“In connection with the need to increase the salary of [Surname of the first and last name of the employee], I order the following change to be made to the staffing table of December 10, 2013 No. 15 from November 18, 2014: by setting the salary of the leading specialist of the accounting department in the amount of 30,000 rubles. Reason: memorandum of the head of the accounting department of material assets dated November 15, 2013.

With the approval of the order, the procedure for changing the salary is completed. The employee gets acquainted with the document, and the personnel officer makes additions to the employee’s personal file, transfers a copy of the order to the accounting department. An additional agreement to the employment contract is concluded with the employee.

Sample order to amend the staffing table

Salary change agreement

Salary change agreement

Since the salary is a condition of remuneration, and therefore a mandatory condition for inclusion in the employment contract. Therefore, the change in salary is accompanied by the execution of such a document as an agreement on salary changes. In everyday life, it is also called an additional salary change agreement. It may contain the following wording about the fact that there is a change in salary:

"1. Amend clause 5.1 of the labor contract dated March 24, 2013 No. 7-TD, concluded between the Employer and the Employee, setting it out as follows:

"P. 5.1. For fulfillment labor function The employee is paid an official salary of 30,000 (thirty thousand) rubles.

2. This supplementary agreement is an integral part of the labor contract dated March 24, 2013 No. 7-TD and comes into force on November 19, 2014.

3. This additional agreement is made in two copies, having equal legal force. One copy is transferred to the Employee, the other remains with the Employer.

Sample supplementary agreement to an employment contract

Salary change notification: when is it drawn up?

Salary change notification: when is it drawn up?

The change in salary can be not only an increase, but also a decrease. How to apply for a salary change if it is expected to be reduced? Two months before the expected date of entry into force of the order to change the salary, the employer warns the employee about changing the terms of the employment contract unilaterally (Article 74 of the Labor Code of the Russian Federation). Exceptions to this rule on notice periods are in Article 306 and Article 344 Labor Code RF. The employee is given a notice of such a change in salary and is asked to put his signature on familiarization. A sample notice of a change in salary (excerpt) is given below.

Sample notice of salary change

.

.

Sample order for termination of an employment contract (dismissal)

Salary Change Order: Preparing a Key Document

Salary Change Order: Preparing a Key Document

After signing an additional agreement to the employment contract on changing the official salary, an appropriate order is prepared. Since, according to the resolution of the State Statistics Committee of Russia dated January 5, 2004, there is a cancellation unified forms intended for use in such cases, an order to change the salaries of employees is drawn up in free form.

Sometimes personnel officers develop a salary change order based on the standard form T-5 (“Order to transfer an employee to another job”), since some software products for personnel records do not provide for the possibility of using documents drawn up in free form. For orders to be taken into account by the program, personnel workers forced to issue them in the form of transfer orders. In such a situation, it can be advised to contact a specialist from the developer who maintains the personnel information base with a request to add the missing forms to the program: this will greatly facilitate the work and make the paperwork process more correct.

Sample request letter for salary increase

the employee will familiarize himself with the finished document, the employee of the personnel department sends a copy of the order to change the salary to the accounting department for further calculation of wages and makes the necessary additions to the employee’s personal file.

the employee will familiarize himself with the finished document, the employee of the personnel department sends a copy of the order to change the salary to the accounting department for further calculation of wages and makes the necessary additions to the employee’s personal file.

Editorial staff of the magazine "Personnel business"

An order to change the salary is a local administrative act of the employer, which is the basis for increasing or decreasing the salary of employees. In the absence of such a document, the adjustment of the amount of the employee's salary is not considered to be completed in accordance with the requirements of the law.

Ways to adjust salaries

Recall that the components of wages are:

- tariff rate, salary;

- base salary, base salary.

Salary changes can take place in a variety of ways.

- The first option is to correct the above elements.

- The second possible option is the appointment or increase in compensation payments.

- The third is the same actions in relation to payments of an incentive format (bonuses, incentives).

The amount of labor associated with the workflow depends on the choice of the method of change, as well as the number of employees to whom it concerns (all or part).

How to get a salary increase

The most common option is to increase cash income. As a rule, it is associated with special merits, high performance the need for additional employee motivation. Consider upgrade options.

For all employees

A similar development of events is associated with the adjustment of the salary of all employees by the same percentage. This is possible during indexing. obliges the employer to increase the amount of income due to rising inflation.

The employer determines the indexing algorithm in the collective agreement or local administrative act. Labor legislation does not establish the frequency and size of such changes, so the organization determines their regularity and size independently. As a rule, rates (salaries) increase by the established coefficient.

The algorithm of the manager’s action if indexation is necessary for all employees is as follows:

- Establish the procedure for the procedure in the collective agreement (in its absence, approve it in the regulation on wages).

- Issue an order on salary indexation with reference to the document in accordance with which it is carried out.

- Make appropriate changes to the staffing table.

- Conclude additional agreements with employees to employment contracts on changing the terms of payment (a sample is given at the end of the article).

Sample letter of change in salary

For individual employees

An individual increase in an employee's income most often occurs at the suggestion of the immediate superior.

The algorithm is the following:

- The immediate supervisor draws up a submission addressed to the employer with a rationale for the need to increase wages and a request to consider such a possibility.

- The employer endorses and approves the submission.

- The employer draws up an order adjusting the staffing table.

- The employer issues personal orders for employees (or one document relating to all those who have undergone changes).

- The employer draws up and signs an additional agreement to the employment contract with the employee.

The last two documents must agree on the dates of entry into force.

How to apply for a pay cut

Salary cuts may be subject to Art. 74 Labor Code of the Russian Federation due to reasons related to new conditions in the organization or work technology. At the same time, by Art. 72 Labor Code of the Russian Federation, reduction is possible in case of revision labor agreement as a result of negotiations between the parties.

The main reasons may be:

- decrease in the income of the organization;

- demotion of an employee;

- reorganization.

The employer does not have the right to reduce the amount on his own initiative.

If the employee does not mind

The employer must Art. 74 Labor Code of the Russian Federation):

- Issue an order on a new procedure for calculating salaries and making adjustments to the staffing table.

- Send each employee a notice of the change in salary and its reasons for at least two months (the employer - a religious organization - at least seven calendar days (Art. 344 of the Labor Code of the Russian Federation), individuals - not less than two weeks (14 days) ( Art. 306 of the Labor Code of the Russian Federation)).

- Make sure that the employee agrees to work in the new conditions.

- Draw up in writing with the employee an additional agreement to the employment contract on changing the salary.

If the employee is against

- In writing, offer the employee another available job (both vacant by qualification, and vacant lower or lower paid). A condition is an opportunity for a person to perform similar functionality in his state of health. In this case, it is necessary to offer all relevant vacancies available in the area. He must offer work in other territories, if this is established by the collective agreement, agreements, labor contract.

- With absence suitable job or refusal of the proposed options at the end of the notice period for the employee, issue an order to dismiss under paragraph 7 of part 1 Art. 77 Labor Code of the Russian Federation.

How to make an order

There is no single template for compiling an administrative document, so it should be formed according to generally accepted rules. These include:

- name of the institution;

- date of formation of the document;

- directly text (indicate full name and position of the employee, new salary, date of new calculation);

- employees responsible for execution.

The document can be issued both on the letterhead of the institution, and on a regular A4 sheet. It is not necessary to certify with a seal. It should include a list of employees by name and specific dimensions raises.

The order is approved by the leader. The persons mentioned in it (both those responsible for execution and the employee himself) get acquainted with the document in writing.